4% Rule? What About 6%?

Random Roger's Retirement Planning

FEBRUARY 10, 2024

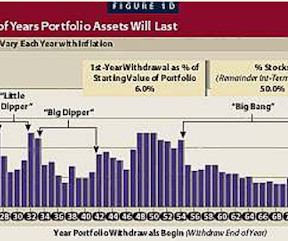

Barron's took on the 4% rule for retirement withdrawals and looked at ways to tweak it to be more flexible. With more years available to study 4% withdrawal outcomes, the odds of getting to the end and leaving a lot of money unspent that could have otherwise made for a better quality of life are quite high.

Let's personalize your content