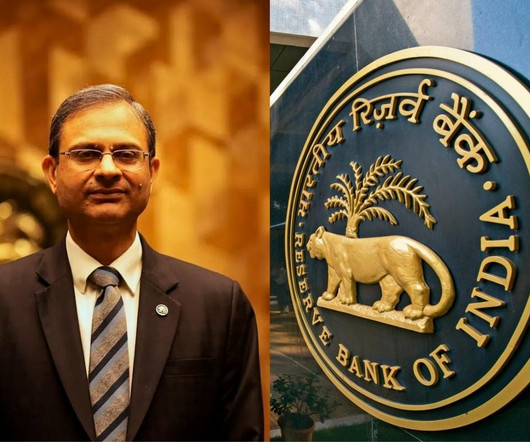

Stocks to Benefit as RBI Cuts Rates for the Third Time; Recommended by Trade Brains Portal

Trade Brains

JUNE 6, 2025

NBFC Stocks in this sector that stand to benefit from the rate cuts include Bajaj Finance, Jio Financial Services, PFC, REC, and IREDA. Also read: Green energy stock jumps after promoter acquires 52,000 shares in the company Sectors & Stocks to benefit & Why 1.

Let's personalize your content