Your Retirement Planning Starter Pack

Carson Wealth

MARCH 7, 2024

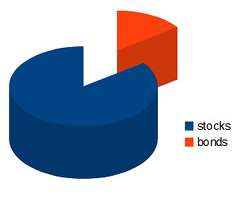

By Jake Anderson, CFP ® , Wealth Planner When helping clients begin retirement planning, the same questions often arise: What should my retirement plan look like? Although there are some basic guidelines, your financial life is as unique as your fingerprint. Looking for personalized retirement planning advice?

Let's personalize your content