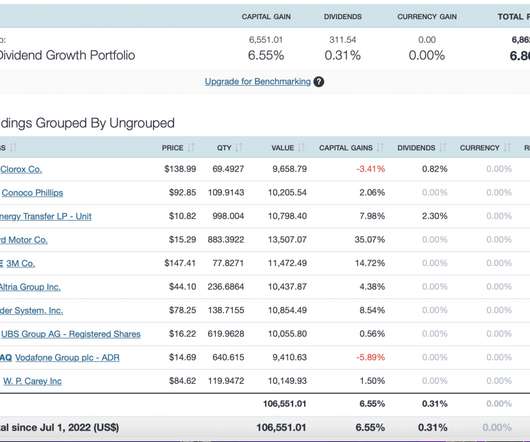

Top 10 Dividend Growth Portfolio

Dear Mr. Market

AUGUST 5, 2022

Inflation is currently at 40 year highs with increasing signs of slowing economic growth. We’re currently seeing one of the largest disparities in valuations between growth and value stocks which in our opinion presents a very appealing opportunity for dividend seeking investors.

Let's personalize your content