Pre-tax vs. Roth (after-tax) 401k Contributions

Good Financial Cents

JANUARY 19, 2023

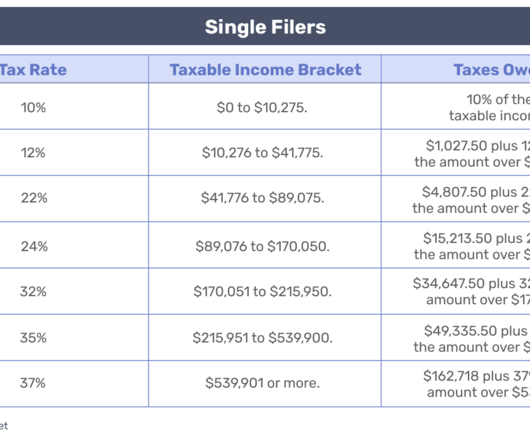

A major decision in retirement planning is whether to make pre-tax or Roth (after-tax) 401k contributions. The money is taken out of your paycheck before taxes are calculated and is then deposited into your retirement account. Pre-tax contributions: Pre-tax contributions are made with money that has not yet been taxed.

Let's personalize your content