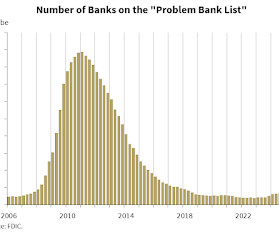

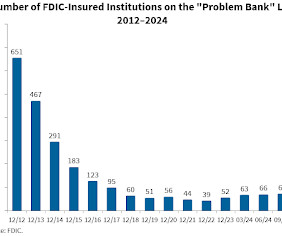

Two Bank Failures in 2024

Calculated Risk

JANUARY 14, 2025

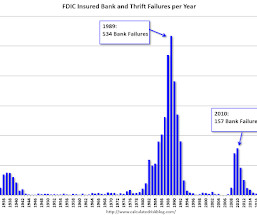

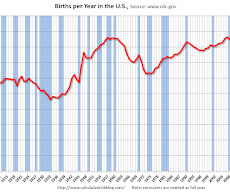

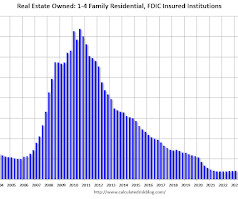

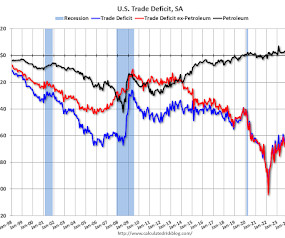

There were four bank failures in 2024. The median number of failures since the FDIC was established in 1933 was 7 - so 2 failures in 2024 was below the median. The first graph shows the number of bank failures per year since the FDIC was founded in 1933. Click on graph for larger image.

Let's personalize your content