Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

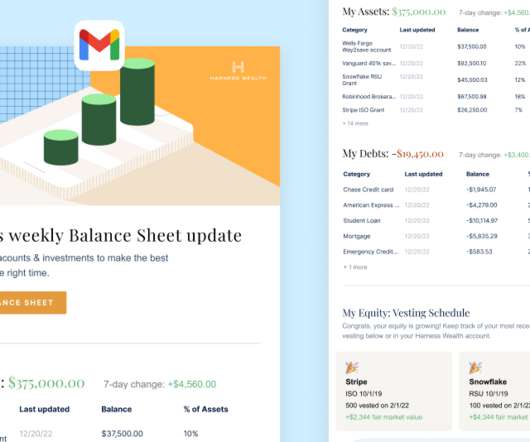

Harness Wealth

DECEMBER 8, 2022

Not only was the stock market fairly volatile, but there were also atypical tax regulation changes. Tax-loss harvesting. Paying taxes on investment gains can be a financial burden, but tax loss harvesting can reduce your bill. You can claim as much capital loss as your realized capital gain plus $3,000.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Zoe Financial

MAY 16, 2023

Qualified withdrawals from a 529 plan are tax-free at the federal level, and some states also offer tax breaks to their residents. It’s important to evaluate the federal and state tax consequences of plan withdrawals and contributions before you invest in a 529 plan.

Wealth Management

MARCH 23, 2023

Make the most of available charitable tax deductions.

Nerd's Eye View

OCTOBER 2, 2023

Welcome to the October 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

MainStreet Financial Planning

MAY 31, 2022

Tax Planning: Things to work on before year-end. Though it may seem that we’ve just put last tax season to rest, now is the time to work on adjustments to optimize your 2022 taxes! Don’t wait until April 15th, 2023, to think about your taxes…there are things that need to get done by year-end!

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. Starting in 2023, a 4% surtax will be applied to taxable income and capital gains over $1M. They paid $300,000 for the house.

Abnormal Returns

NOVEMBER 6, 2023

papers.ssrn.com) Taxes A 2023 year-end tax planning guide. kitces.com) Advisers How the profession of financial planning has changed over time. (investmentnews.com) M&A The RIA model continues to take share. riaintel.com) How to prep an RIA for sale. (fa-mag.com) fa-mag.com) Research into how RIAs grow.

Darrow Wealth Management

OCTOBER 21, 2022

The IRS has released the 2023 contribution limits for retirement plans and other cost-of-living adjustments. The agency also released tax brackets for ordinary income and long-term capital gains. Contribution Limits for 401(k)s, IRAs and More in 2023. Income Tax Rates in 2023.

Harness Wealth

JANUARY 24, 2023

However, it is important to keep in mind that different states and territories have varying tax laws and some may be more favorable than others. So before you set off on your big move, consider the specific tax implications of doing so. Who knows, you might even find a more tax-friendly destination along the way.

Nerd's Eye View

DECEMBER 22, 2023

Also in industry news this week: The SEC has been sending letters to advisory firms requesting details on their use of AI technology, raising questions about whether they may be considering revising their proposed AI rule that received significant pushback earlier this year for the wide breadth of the types of technology it covers DPL Financial has (..)

Harness Wealth

MARCH 31, 2023

The Igloo Company Pudgy Penguin #7625 – source: sothebys.com As non-fungible tokens (NFTs) have gained mainstream popularity, it’s essential to understand the tax implications associated with these crypto assets. Table of contents Introduction to NFTs How are NFTs taxed Taxes when buying NFTs Can NFTs be taxed as collectibles?

Integrity Financial Planning

NOVEMBER 14, 2023

We’re coming up on the end of the year, and while it’s a time to take a break and enjoy the holiday season, it’s also a good time to consider tax strategies that may benefit you. Gift Tax Exemptions Each year, you can give up to $17,000 to any number of people tax-free.

Harness Wealth

MARCH 10, 2023

Whether you’re in venture capital, private equity, or angel investing, it’s important to understand the tax implications of your investment income. One of the unique characteristics of carried interest is that it is taxed as a capital gain rather than ordinary income. K-1 forms are reported on an individual’s tax return.

Integrity Financial Planning

JULY 17, 2023

How you handle taxes and when you are taxed are two of the most important factors when it comes to retirement planning. There are also Roth 401(k)s that have a similar tax treatment but are subject to some different rules.

Abnormal Returns

APRIL 10, 2023

blog.xyplanningnetwork.com) Technology Highlights from the 2023 T3 Advisor Conference including the growing importance of tax planning software. (etf.com) Onboarding Evan Harp, "To move the needle on diversity, organizations must not simply hire diverse talent and call it a day — they must develop that talent as well."

Harness Wealth

MARCH 17, 2023

If you’d like to learn more about DeFi taxes as it relates to your personal situation, contact a Harness Tax Advisor today. Overview of DeFi Use-Cases and Their Tax Implications Before diving into specific tax implications, it is essential to understand the various DeFi use cases and their potential tax consequences.

Integrity Financial Planning

JUNE 12, 2023

As you plan for retirement, it’s important to consider tax optimization strategies to minimize your tax liabilities. Here are three key ways to optimize taxes in retirement, based on information from sources published between 2022 and 2023.

Abnormal Returns

JANUARY 16, 2023

thinkadvisor.com) Taxes Some steps you can take to upgrade your tax-planning game. blogs.cfainstitute.org) How Merit Financial Advisors is building out its tax practice. thinkadvisor.com) The biz The M&A has shifted in 2023 with a focus on firms with alts capacity. citywire.com) A CPA shortage is looming.

Nerd's Eye View

NOVEMBER 18, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that AdvisorTech giant Envestnet has announced a partnership with New Zealand-based FNZ that will allow Envestnet to offer custodial services to advisors beginning in the second half of 2023.

XY Planning Network

JANUARY 6, 2023

So much occurred in 2022, and we're excited (and anxious) to see what 2023 has in store! 4 MIN READ. Another year has come and gone in what feels like a blink of an eye.

Advisor Perspectives

DECEMBER 26, 2023

Advisors are being asked to provide their clients with a full suite of solutions, ranging from estate and tax planning to portfolio management, and everything in between. Clients are increasingly eager to gain access to fully customizable solutions that meet their individual needs.

Advisor Perspectives

FEBRUARY 8, 2023

With the new year in its infancy, it may be too early to think about where to spend Thanksgiving or booking your car’s fall tune-up.

Darrow Wealth Management

JANUARY 30, 2023

just upended retirement planning…again. The age when retirees must begin drawing from non-Roth retirement accounts increases to 73 in 2023, then 75 in 2033. Raising the age when withdrawals must begin is great as it gives investors more planning opportunities. The Secure Act 2.0

James Hendries

AUGUST 10, 2022

The IRS has released the 2023 contribution limits for health savings accounts (HSAs), as well as the 2023 minimum deductible and maximum out-of-pocket amounts for high-deductible health plans (HDHPs). An HSA is a tax-advantaged account that’s paired with an HDHP. High-deductible health plan: self-only coverage.

Nerd's Eye View

OCTOBER 14, 2022

for 2023, the largest COLA since 1981. While this will help seniors keep pace with rising prices, it also creates tax planning opportunities for advisors and raises the possibility that the Social Security Trust Fund could be depleted sooner than expected.

Abnormal Returns

SEPTEMBER 26, 2022

Podcasts Christine Benz and Jeff Ptak talk with Tim Steffen, director of tax planning for Baird. bpsandpieces.com) The 2nd annual Future Proof conference is set for Huntington Beach, CA, on September 10-13, 2023. morningstar.com) Michael Kitces and Carl Richards talk about repurposing lessons from clients for content.

Harness Wealth

MARCH 9, 2023

Reddit is planning an IPO for the second half of 2023. But between subpar macroeconomic conditions and a lackluster IPO market, the plans were soon put back on the shelf. As of now, Reddit has yet to announce a date for its initial public offering (IPO), but all signs are pointing to the second half of 2023.

Zoe Financial

JUNE 5, 2023

Market Drama Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA June 5, 2023 Watch Time: 2 minutes Welcome to this week’s Market Drama! Let us connect you with the best financial advisor for you to understand the implications of the markets in your personal financial plan. The Stock Market: The S&P 500 was up 1.8%

Carson Wealth

APRIL 25, 2024

Tax Planning: Optimize tax efficiency through strategies such as retirement contributions, tax-deferred accounts, and deductions and credits. Estate Planning: Draft essential documents such as wills, trusts, and powers of attorney to ensure the orderly transfer of assets. 2 USA Today, “Think you’ll work past 70?

Zoe Financial

MAY 23, 2023

Market Drama Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA May 23, 2023 Watch Time: 3 minutes Welcome to this week’s Market Drama! Let us connect you with the best financial advisor for you to understand the implications of the markets in your personal financial plan. The Stock Market: The S&P 500 was up 1.6%

Darrow Wealth Management

JANUARY 9, 2023

was signed into law December 29th, 2022, bringing more major changes to tax law. 529 plan to Roth IRA rollovers. The individual must be the designated beneficiary of the 529 plan and move funds to a Roth IRA in their name. Amount rolled over is tax-free (not included in beneficiary’s income) and penalty-free.

Nationwide Financial

JANUARY 25, 2023

On the other hand, not having a plan can lead to emotional investment decisions during periods of high volatility – something every investor should avoid. However, strategies such as asset location and tax loss harvesting can significantly minimize taxes on investments.

Zoe Financial

DECEMBER 5, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA December 5, 2023 Watch Time: 3 minutes Transcript: Welcome to this week’s Wealth Management Digest. Financial planning, estate planning, tax planning, etc, rather than just picking stocks like in the old days.

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help with maximizing your retirement income through tax planning After retirement, your income sources may become limited to pensions, Social Security benefits, and investment income. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

Harness Wealth

APRIL 28, 2023

If you earn income from various sources throughout the year, such as equity windfalls, venture capital fund distributions, crypto investments, and sales, or small business income, you will need to pay estimated quarterly taxes. Table of Contents What Are Estimated Quarterly Taxes?

MainStreet Financial Planning

DECEMBER 8, 2022

The choice to defer is only permitted for tax year you turn 72 in, the year of your first RMD. For example, if you choose to defer your 2022 RMD until April 1, 2023, you will still need to withdraw your 2023 annual RMD by December 31, 2023). Please contact your plan administrator for more details.

Harness Wealth

MAY 25, 2023

The right advisor can help manage your wealth, plan for retirement, navigate tax implications, and more. Here’s a deep dive into the average fees of financial advisors, in 2023. Here, we’ll break down the different types of fees that financial advisors charge in 2023.

Darrow Wealth Management

NOVEMBER 20, 2023

Considering Roth conversions in retirement When you convert pre-tax money from an IRA to an after-tax Roth IRA, the amount converted is included in your taxable income. But in retirement, without a paycheck, it can be a great opportunity to control your tax situation for the year and fill up the lower tax brackets.

Zoe Financial

JANUARY 17, 2024

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA January 17, 2023 Watch Time: 3 minutes Transcript : Welcome to this week’s Wealth Management Digest. The second headline was Edelman Financial engines closed down their tax prep services (separate/different from their tax planning services).

Harness Wealth

DECEMBER 19, 2022

As you wrap up 2022 and look ahead to the new year, consider how to get an early start on understanding your finances and how to manage your tax liability, especially if you experienced any changes in equity compensation or made or sold an investment. Understand the tax implications associated with crypto assets.

Darrow Wealth Management

SEPTEMBER 7, 2023

Pros and cons of exercising stock options in a pre-IPO window If you are new to the tax implications and basics about exercising stock options, please read this article first. Unfortunately, for those tax savings to materialize, the post-IPO stock price at sale must be considerably more than the pre-IPO valuation at exercise.

Indigo Marketing Agency

FEBRUARY 2, 2023

For instance, the Heath Walters Institute offers on-demand tax planning and support for financial advisors who want to better serve their high-net-worth clientele.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content