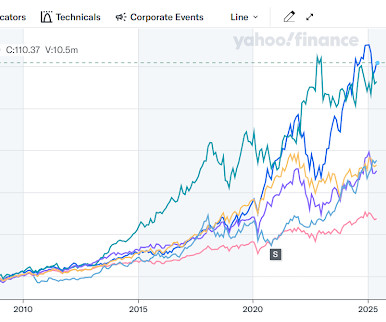

A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

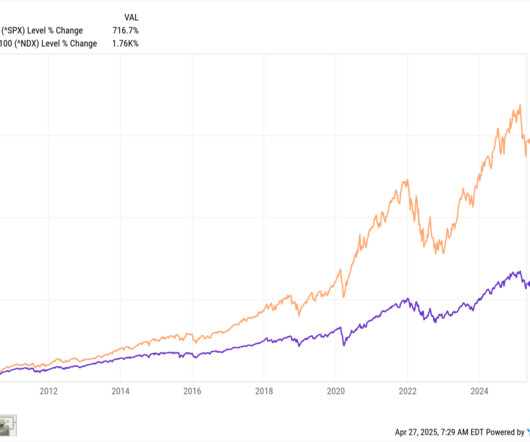

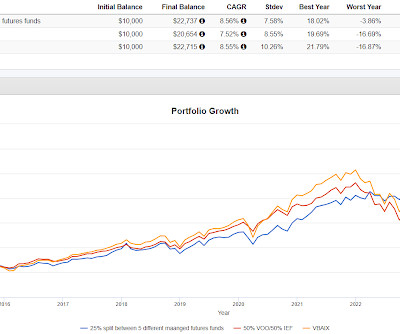

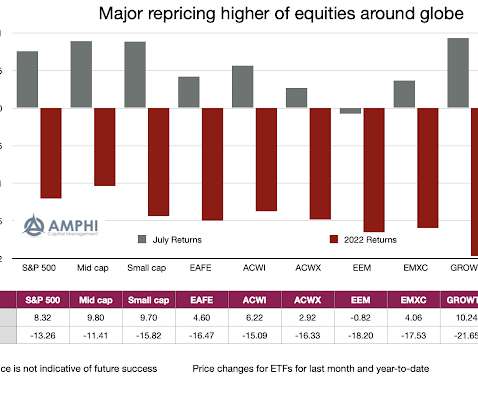

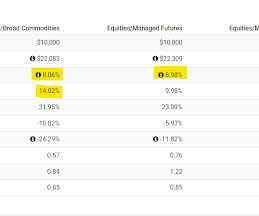

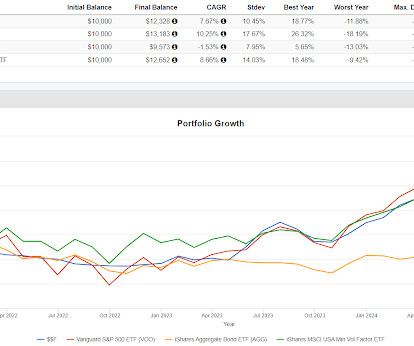

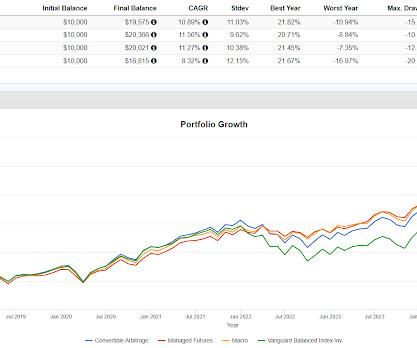

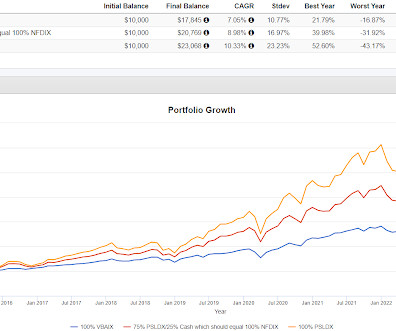

2022 down 18% for the year.4 What has developed over the entirety of the post-financial crisis era of rising equity markets and until 2022, falling or zero interest rates.The good news is that this is how you build wealth over the long haul. Financial Repression was the rallying cry for underperforming managers.

Let's personalize your content