The “Art” of Market Timing

The Big Picture

NOVEMBER 27, 2023

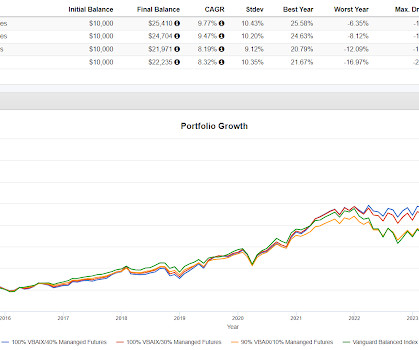

Low Stakes : The most successful market timers are often those people who do not have actual assets at risk. Staying long through the 60-day 34% drop during the 2020 pandemic; getting out of the market ahead of the 2022 rate hiking cycle; and getting back in October 2022 for the next bull leg. It’s utterly laughable.

Let's personalize your content