Be Like You

The Big Picture

MAY 5, 2025

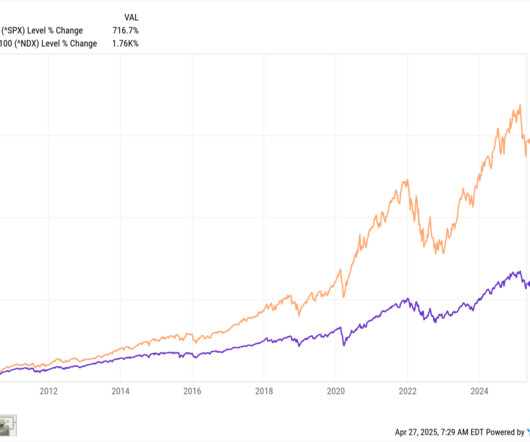

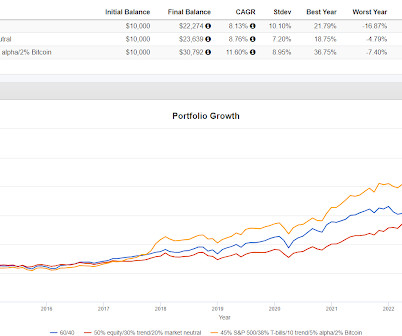

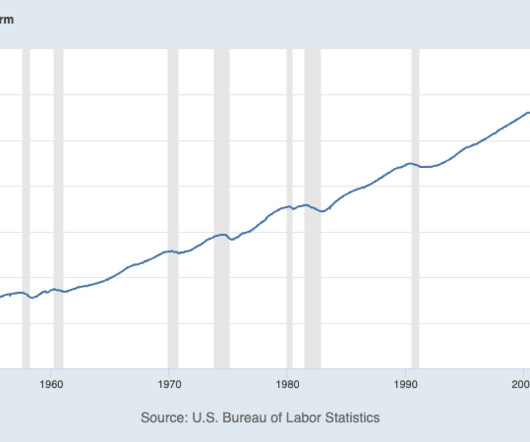

Own Broad Indexes as a Core Portion of your Portfolio Thats it! Recognize why he was able to do what he did, and how incredibly difficult it was. And listen to the advice he poured forth for Mom & Pop investors: 1. Bet on America 2. Manage Your Own Behavior 3. Being the next Warren Buffett? Thats all but impossible. Be like you.

Let's personalize your content