Is Big Tech’s dominance over?

Nationwide Financial

FEBRUARY 1, 2023

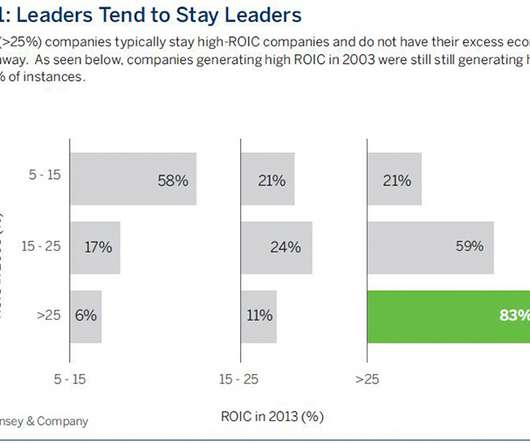

These recurring shifts in the composition of the benchmark stock Index can offer insight into how different factors, such as cyclicality, long-term growth potential, and valuation, may impact stock performance in the future. The outsized influence of tech company earnings on the S&P 500 is important to understand.

Let's personalize your content