Global Leaders Strategy Investment Letter: January 2024

Brown Advisory

JANUARY 17, 2024

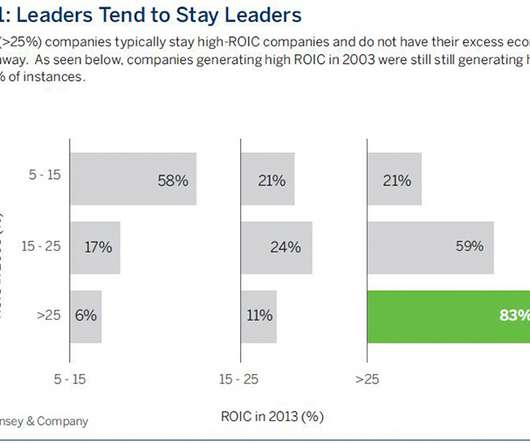

Both types of error are due to a combination of either mis-assessing the business quality or its valuation (or both). Our 10/10/3 valuation framework using a 10% weighted average cost of capital is undoubtedly conservative and ends up with us missing some big opportunities as type 2 errors of omission.

Let's personalize your content