Revisiting the Market Valuation in the Wake of This Year’s Decline

Validea

SEPTEMBER 21, 2022

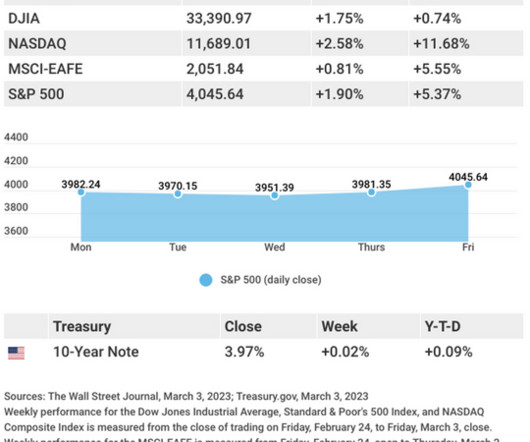

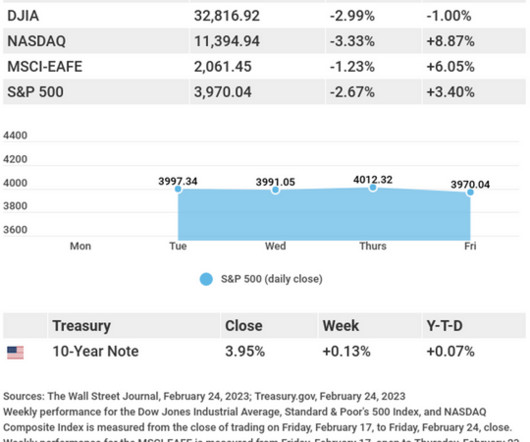

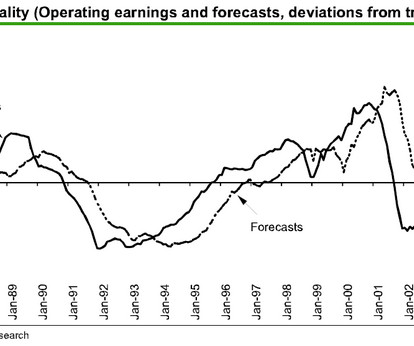

With the S&P 500 now close to 20% off its highs, I thought now might be a good time to look to our market valuation tool to see where things stand. But before I do that, I wanted to first cover two caveats I always put in articles about market valuation. With that all being said, let’s look at the current valuation data.

Let's personalize your content