5 Unusual Economic Indicators That Can Tell You About the Economy

Trade Brains

DECEMBER 28, 2023

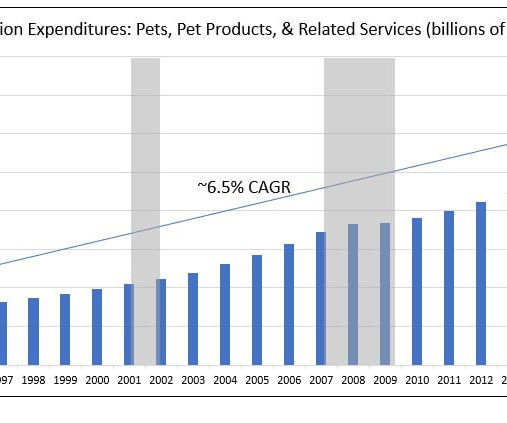

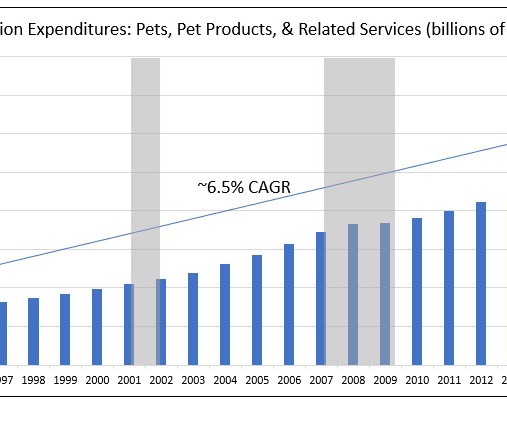

Unusual Economic Indicators : You might have heard about indicators like the Big Mac Index (if you haven’t, you can read our previous article). However, there are many other lesser-known indicators that can actually provide valuable insights and are helpful for the economy. Most Unusual Economic Indicators 1. What is it?

Let's personalize your content