Markets attempt a bounce on encouraging earnings

Nationwide Financial

OCTOBER 24, 2022

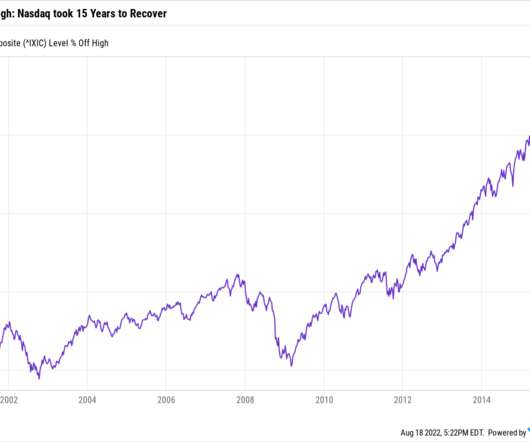

This is similar to the market behavior near the bottoms in 2002, 2009, 2011, and 2020, reflecting the willingness of institutional investors to dip their toe back in the water. equities, and long ESG assets. PMI data reflect the global slowdown, with eurozone composite PMI well into correction territory at 47.1, What to Watch.

Let's personalize your content