10 Tuesday AM Reads

The Big Picture

AUGUST 29, 2023

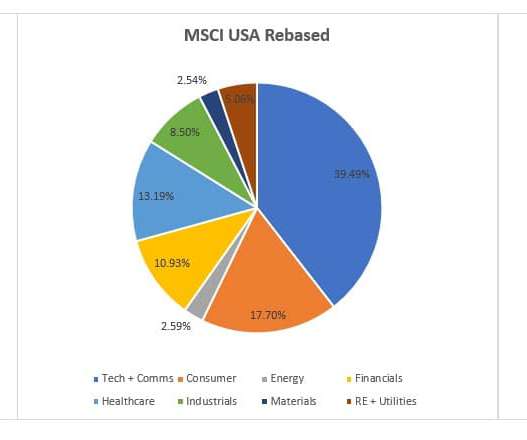

My Two-for-Tuesday morning train WFH reads: • Stock Pickers Never Had a Chance Against Hard Math of the Market : In years like this one, when just a few big companies outperform, it’s hard to assemble a winning portfolio. The leading economic indicators show the U.S. 2007-09 Great Financial Crisis 7. 1987 Crash 3.

Let's personalize your content