Private Credit Outshines Many High-Valuation Stocks, Bonds

Brown Advisory

SEPTEMBER 12, 2016

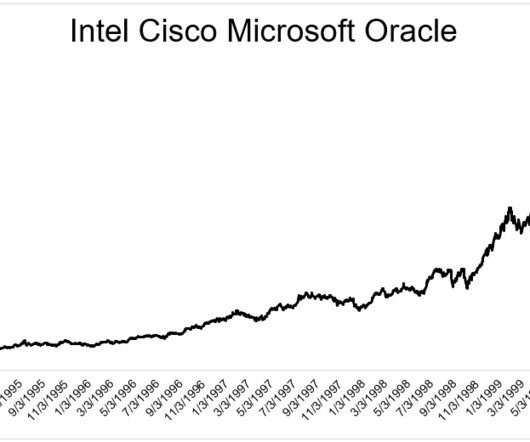

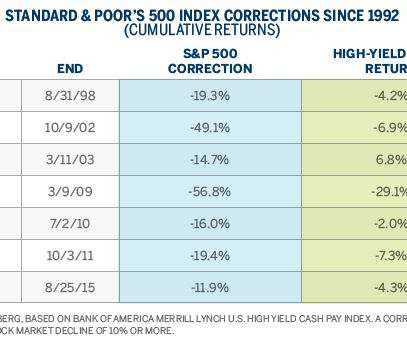

Private Credit Outshines Many High-Valuation Stocks, Bonds. With interest rates at record lows and many publicly traded bonds and stocks approaching historically high valuations, private credit has become increasingly attractive to investors because of its total return prospects, steady income and role in diversification.

Let's personalize your content