Three Things – Exponential AI

Discipline Funds

MAY 28, 2025

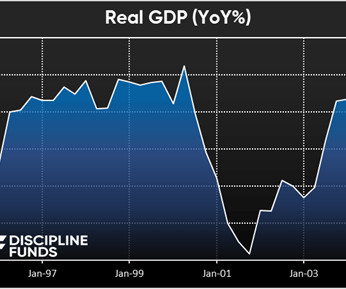

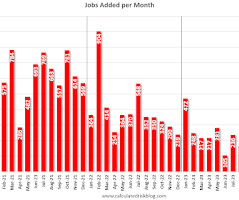

The whole economy is going to become increasingly decentralized. Entrepreneurs and consultants who can leverage AI and help other people navigate the economy will become more valuable. Speaking of recessionsI’ve always been critical of the idea that technology is bad for the economy.

Let's personalize your content