Market Commentary: Checking In on Market Fundamentals

Carson Wealth

APRIL 8, 2024

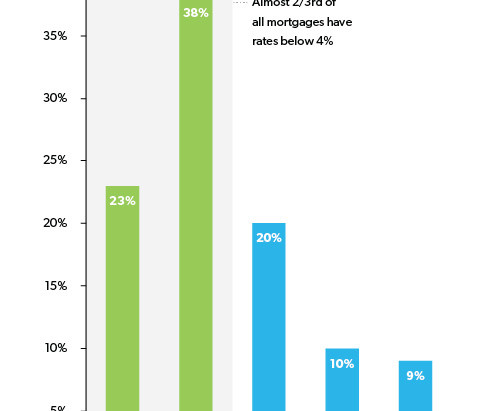

Pockets of attractive valuations exist despite above-average valuations in some high-profile areas of the market. The measure is at 80.7%, exactly where it was a year ago and higher than at any point between July 2001 and February 2020. Following the huge 11.2% But does a strong labor market raise inflation concerns?

Let's personalize your content