Round Trip

The Big Picture

AUGUST 1, 2023

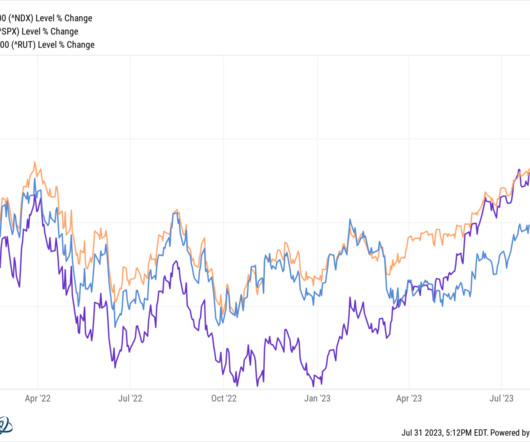

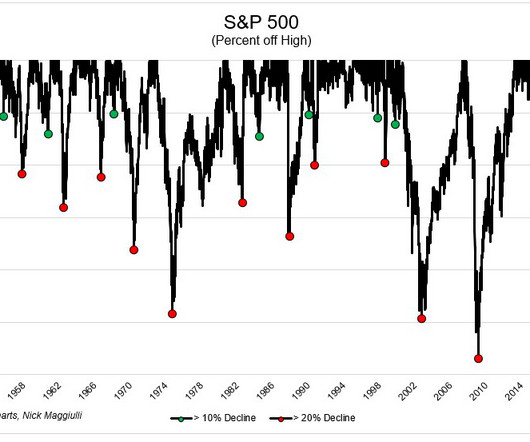

but the giveback off the highs was substantial: S&P 500 was down ~23%, Russell 2000 was off 27%, and the Nasdaq 100 came down 32%. are fast-growing, highly profitable key players in the modern economy. But we won’t know how big a losing trade it might be until early 2024, when we see the updated valuations. End of ZIRP?

Let's personalize your content