Round Trip

The Big Picture

AUGUST 1, 2023

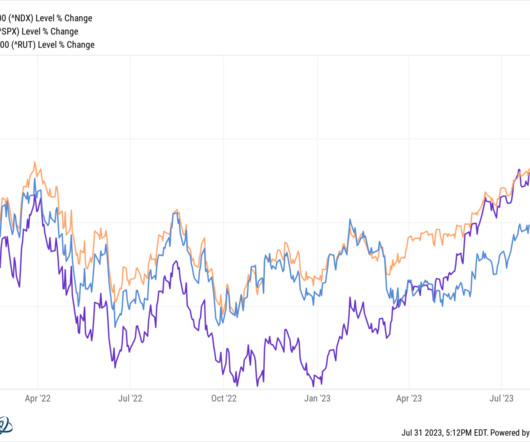

but the giveback off the highs was substantial: S&P 500 was down ~23%, Russell 2000 was off 27%, and the Nasdaq 100 came down 32%. Recall John Kenneth Galbraith’s observation: “The only function of economic forecasting is to make astrology look respectable.” Blame whatever you want – Too far, too fast? End of ZIRP?

Let's personalize your content