Investing for Longevity: Wealth Creation Inspired by Blue Zone Habits

Validea

SEPTEMBER 13, 2023

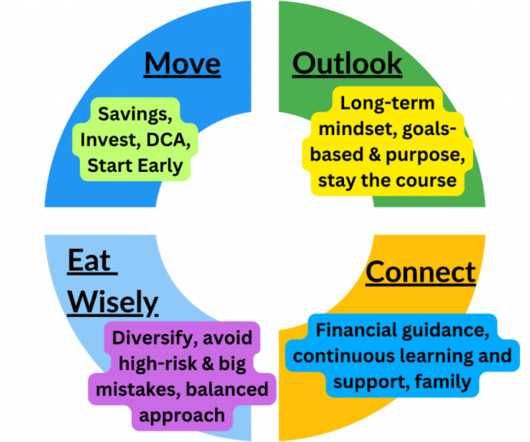

While Blue Zones offer us a glimpse into the art of living well, perhaps some of these principles can be related to optimize your wealth creation over time. The purpose of this article is to explore how adopting the principles observed in Blue Zones can relate to successful long-term savings, investing and wealth creation.

Let's personalize your content