Impact of New $15M 'Permanent' Estate/Gift Tax Exemption

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Taxes Related Topics

Taxes Related Topics

Wealth Management

JULY 7, 2025

Explore how the new $15 million federal estate tax exemption affects lifetime transfer planning and strategies for high-net-worth clients.

Nerd's Eye View

FEBRUARY 5, 2025

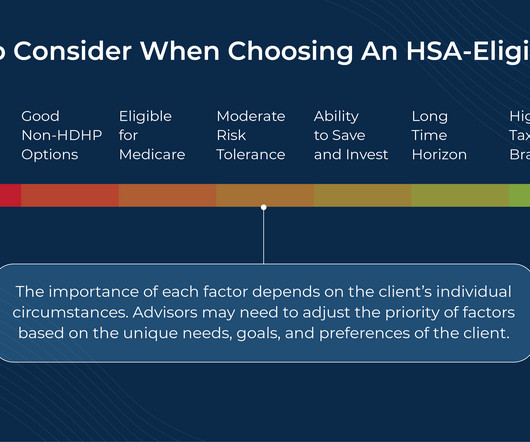

Health Savings Accounts (HSAs) have become an increasingly popular tool for financial advisors and their clients due in part to the 'triple tax savings' they offer: tax-deductible contributions, tax-free growth, and non-taxable distributions for qualifying expenses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JULY 14, 2025

New law increases transfer tax exemptions, raises SALT deduction cap, preserves TCJA rates, expands QSBS benefits and continues QBI deduction.

Wealth Management

JULY 18, 2025

The 20% deduction for qualified business income, including REIT dividends, has been made permanent in the new tax law, reducing effective tax rates for investors.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

Nerd's Eye View

JUNE 18, 2025

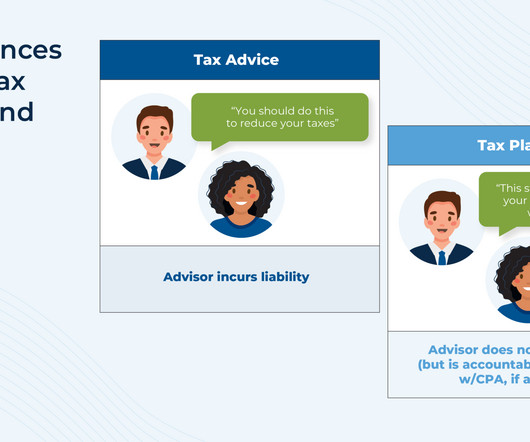

In recent years, financial advisors have increasingly embraced tax planning as a core element of delivering value to clients. But as the profession has evolved toward more holistic planning, tax considerations have likewise expanded into more areas of advice, including Roth conversions, charitable strategies, and small business structuring.

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Speaker: Rita Keller - President of Keller Advisors, LLC

You've worked diligently and have built a glowing reputation grounded in your excellent skills in tax, accounting, and auditing. You're known as the “go-to” person when a client is faced with tax and financial decisions. You have a very successful firm -- but that’s not enough.

Advertiser: G-P

This option allows foreign employers with no entity in-country to make special “payroll-only” registrations with in-country tax and social security bodies so they can issue a local payroll. Simple, right? Before you go forward with payroll-only registration as a solution, you should know it’s more complex than just filing some paperwork.

Let's personalize your content