Why Moving To A Lower-Tax State Doesn’t Always Result In Lower State Taxes On Deferred Income

Nerd's Eye View

MARCH 13, 2024

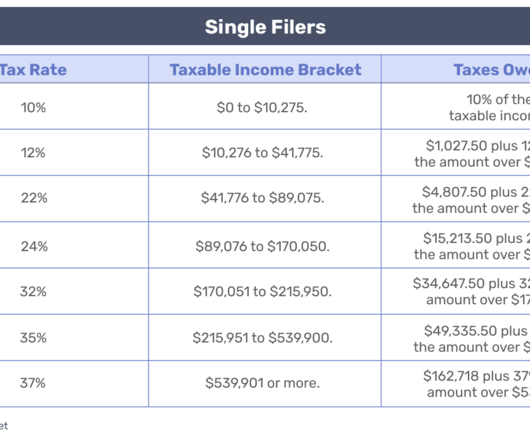

Most of the time, people are subject to state taxes in the states where they live and/or earn their income. So when moving to a lower-tax state or another, their income tax burden likewise shifts to the new state along with them.

Let's personalize your content