Effective Implementation Of A Backdoor Roth Strategy: Detailed Nuances, IRS Form 8606 (And When It’s Even Worth Doing)

Nerd's Eye View

NOVEMBER 1, 2023

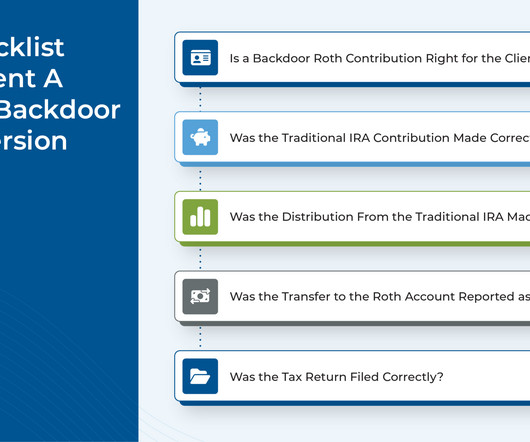

The backdoor Roth strategy can be valuable for clients whose high income levels preclude them from making regular contributions to a Roth IRA. Thus, the strategy itself consists of a 2-step process involving 1) a contribution (either deductible or non-deductible) made to a traditional IRA, followed by 2) conversion into a Roth IRA.

Let's personalize your content