Effective Implementation Of A Backdoor Roth Strategy: Detailed Nuances, IRS Form 8606 (And When It’s Even Worth Doing)

Nerd's Eye View

NOVEMBER 1, 2023

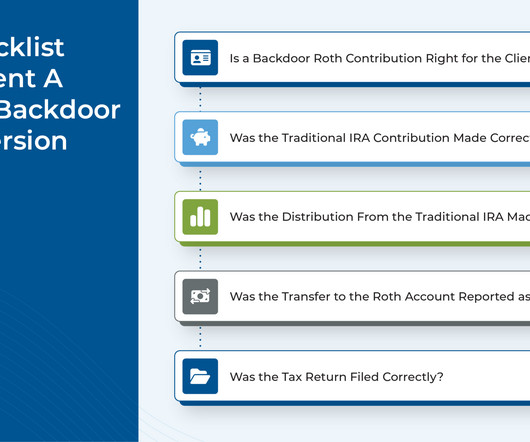

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. The backdoor Roth strategy can be valuable for clients whose high income levels preclude them from making regular contributions to a Roth IRA.

Let's personalize your content