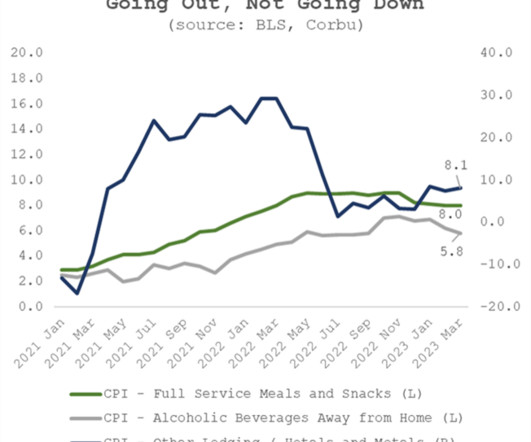

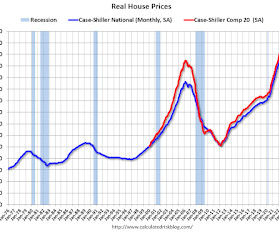

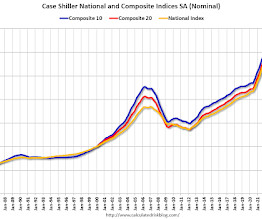

The Tide of Price over Volume

The Big Picture

APRIL 21, 2023

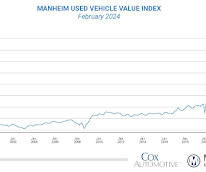

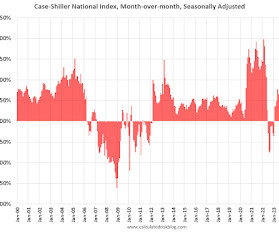

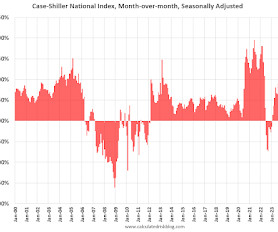

My fishing pal Sam Rines has spent much of this year pushing a thesis of “ Price over Volume” ; I found it a compelling narrative, one that fits in nicely with an apsect of inflation that I had originally underestimated: “Greedflation.” ” The Price over Volume thesis is both compelling and underappreciated.

Let's personalize your content