Planning For Adoption: Understanding Different Pathways And Their Costs, Tax Breaks, And Financial Assistance Available

Nerd's Eye View

AUGUST 2, 2023

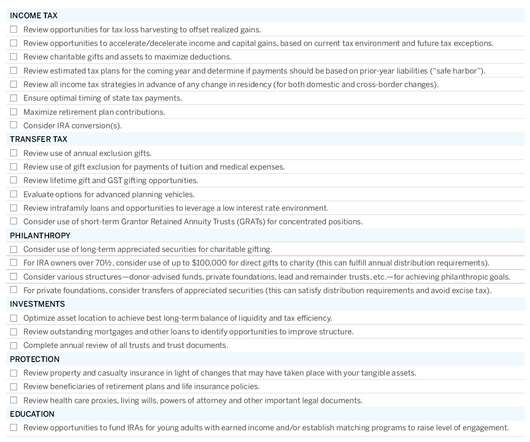

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses. Read More.

Let's personalize your content