Personal finance links: peaks and valleys

Abnormal Returns

JULY 12, 2023

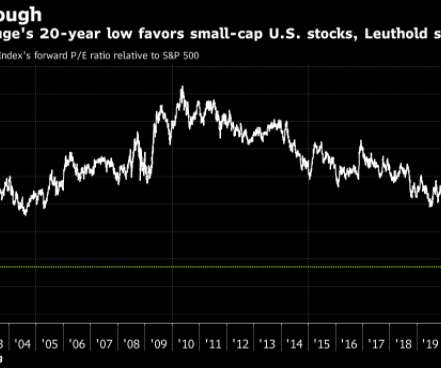

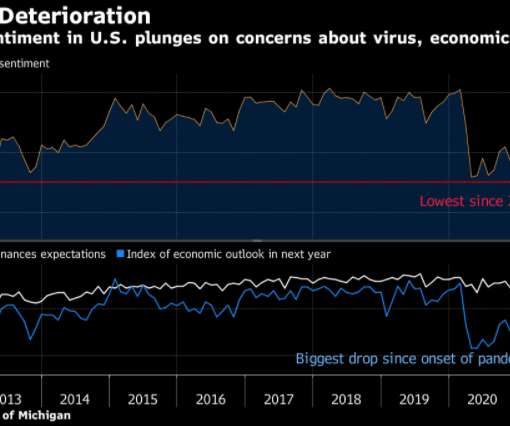

stocks are enough for your portfolio. morningstar.com) On average, people overestimate their risk tolerance. genyplanning.com) An inheritance raises a number of questions, and opportunities. James Choi about how economic theory explains consumer behavior. etftrends.com) Peter Lazaroff on whether U.S.

Let's personalize your content