Maximizing Health Savings Accounts (HSAs) Tax Benefits With Adult Children Under Age 26

Nerd's Eye View

NOVEMBER 9, 2022

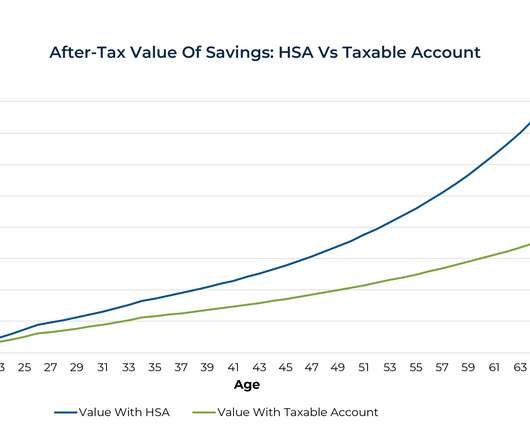

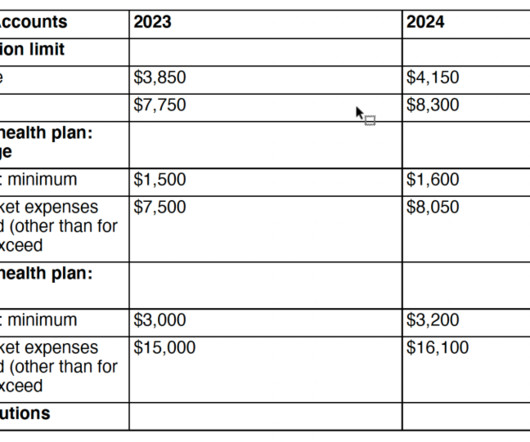

Health Savings Accounts (HSAs) are one of the most popular savings vehicles because of their triple-tax advantage: account owners can take an above-the-line tax deduction for eligible contributions, growth in the account is tax-deferred, and withdrawals are tax-free if they are used for qualified healthcare expenses.

Let's personalize your content