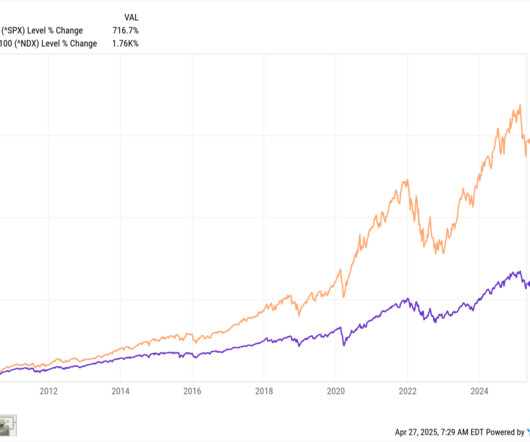

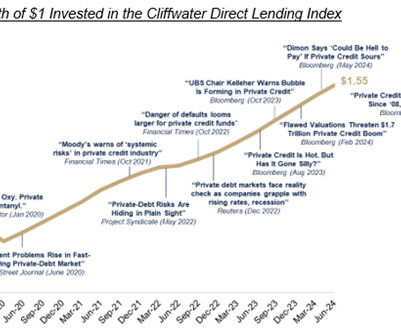

A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

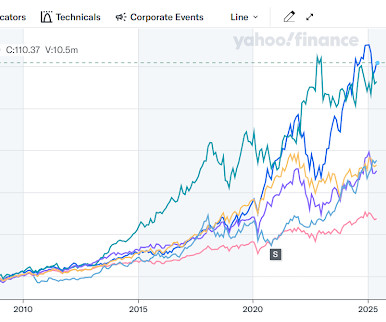

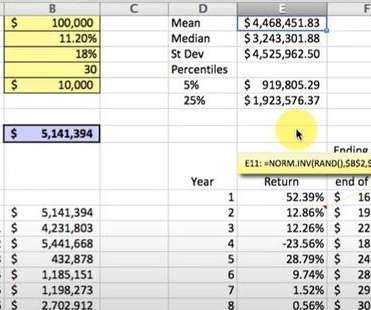

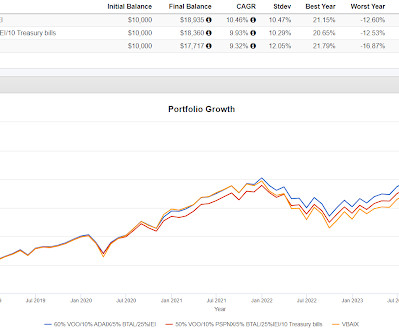

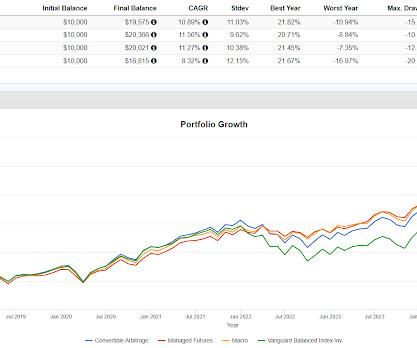

This is a direct result of muscle memory a Recency Effect impact driven by 15 years of market gains. What has developed over the entirety of the post-financial crisis era of rising equity markets and until 2022, falling or zero interest rates.The good news is that this is how you build wealth over the long haul.

Let's personalize your content