Diversification and Risk Management With Fixed Income

Wealth Management

APRIL 7, 2024

Higher interest rates bring fixed income and alternative investments into the spotlight again.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

APRIL 7, 2024

Higher interest rates bring fixed income and alternative investments into the spotlight again.

Nerd's Eye View

JANUARY 24, 2025

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

The Big Picture

APRIL 28, 2025

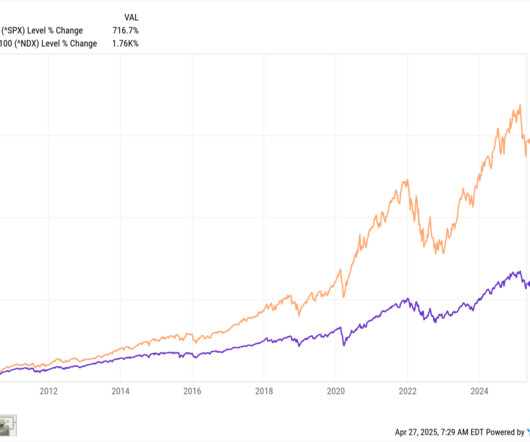

is not what risk managers call a rational trading day. The risk is that if and when the trend changes, some traders will be slow to adapt; investors may get discouraged when they learn that investing for the “long term” isn’t measured in months or quarters, but in decades.

Wealth Management

OCTOBER 6, 2023

Beacon Pointe CIO Michael Dow and Director of Risk Management and Securities Research Julien Frazzo like U.S. large cap value and bonds.

Carson Wealth

FEBRUARY 4, 2025

Understanding Tax Compliance and Risk Management Ultra-high-net-worth individuals face unique tax challenges, including high rates and ever-changing complex tax codes. If managed improperly or inefficiently, tax issues could significantly erode your familys wealth and even lead to legal complications.

Random Roger's Retirement Planning

OCTOBER 28, 2024

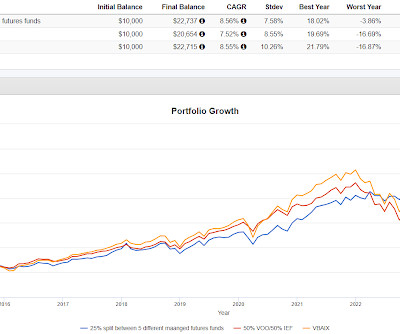

On Monday afternoon I sat in on a webinar put on by RCM Alternatives with Jon Robinson from Blueprint Investment Partners and Jerry Parker who is a pioneer in trend following with managed futures. Yes but I think in terms of the portfolio, I believe managed futures helps to manage the risk of the portfolio.

The Big Picture

JUNE 24, 2023

This week, we speak with Peter Borish, who is chairman and chief executive officer of Computer Trading Corporation, an investment and advisory firm. Borish was founding partner and right-hand man to Paul Tudor Jones at Tudor Investment Corporation , where he was director of research for 10 years.

Risk Management Guru

NOVEMBER 20, 2023

As the year 2023 draws to a close, it’s time to reflect on the significant strides made in the realm of Risk Management within the financial services industry. However, the industry has also made significant progress in strengthening its risk management capabilities.

Abnormal Returns

JULY 26, 2022

evidenceinvestor.com) Research The accounting treatment of intangible investments is too conservative. (papers.ssrn.com) It's hard to find much evidence in favor of individual investor outperformance. alphaarchitect.com) Some evidence that investors get smarter as they age. morganstanley.com) Broad value indices are really not that value-y.

Wealth Management

JUNE 12, 2025

What Are the Best Asset Classes for Active Management? Low-cost passive wrappers work well for core equity investing, but certain asset classes are more conducive to active management. His infrastructure team, which includes analysts in New York, Europe and Asia, is trying to identify and understand regulatory risks.

Validea

OCTOBER 12, 2022

But many investors have not seen significant inflation during their investing careers and didn’t recognize that during inflationary bear markets, bonds do the opposite and fall along with stocks. The fact that bonds haven’t worked has made risk management very challenging during this bear market. Permanent Portfolio – Grade: C.

BlueMind

OCTOBER 25, 2022

Category: Clients Risk. When it comes to their investment portfolios many tend to have a low-risk tolerance and with the unsettling economic situation with the ongoing pandemic, the word “risk” has become even more of a fearsome word for clients. Would they consider a 5% return worth taking a risk or 20%?

Norman Marks

MARCH 4, 2024

Professor Mark Beasley has been a professor for 30 years and is a leader of the North Carolina State University’s Enterprise Risk Management Initiative. He was a board member of COSO for 7 years, has been a member of the member of the United Nation’s Internal Control Advisory Group for the last 7 years, and […]

The Big Picture

SEPTEMBER 16, 2023

This week, we speak with Elizabeth Burton , managing director and client investment strategist at Goldman Sachs Asset Management. She advises institutional clients on investment strategies and portfolio objectives, working alongside global client advisers and product strategists across public and private markets.

Abnormal Returns

JULY 26, 2024

(epsilontheory.com) Joe Weisenthal and Tracy Alloway talk with Rich Falk-Wallace, founder and CEO of Arcana, about building risk management tools for pod shops. bloomberg.com) Jeff Malec talks with DeWayne Louis and Nishant Gurnani from Versor Investments about quantitative investment strategies.

The Big Picture

MAY 29, 2024

So it’s, we have this division that it’s maybe a third to 40 percent of all the private wealth that we manage for very wealthy people. The investments in your trust are going to be managed differently than your IRA because we’ve accounted for your estate plan as part of it. Part of it’s risk management.

Calculated Risk

OCTOBER 12, 2022

Most participants remarked that, although some interest-sensitive categories of spending—such as housing and business fixed investment—had already started to respond to the tightening of financial conditions, a sizable portion of economic activity had yet to display much response.

Risk Management Guru

OCTOBER 3, 2022

There are basically five strategies which can help you in allocating your risk management. If you have a firm grasp of these elements and how they influence stock market fluctuations, you will be in a better position to plan your investments. Any other approach will reduce your investments to mere gambling. Conclusion.

David Nelson

JANUARY 3, 2023

By David Nelson, CFA CMT All branches of the military use ORM or their own Operational Risk Management system. We identify the risks even those with low probability and make a quantitative judgement as to the feasibility of the mission and or flight.

Trade Brains

JUNE 20, 2025

Powered by a proprietary tech stack, Nimbus, nPOS, Nu Score, and Altifi Northern Arc ensure efficient credit delivery and risk management. As of FY25, it manages a fund AUM of Rs 3,158 crore, lending AUM of Rs 13,634 crore, with disbursements of Rs 19,840 crore. are their own, and not that of the website or its management.

Validea

NOVEMBER 9, 2024

Martin Zweig may have owned one of the most expensive penthouses in Manhattan, but his path to wealth was paved with disciplined, methodical investing rather than risky speculation. By high school, he had already set his sights on becoming a millionaire through stock investing.

Abnormal Returns

APRIL 26, 2023

morningstar.com) Peter Lazaroff talks 'simple investing' with Rick Ferri. nextbigideaclub.com) Personal finance Tony Isola, "The best risk management strategy is taking care of your mind and body, not regular rebalancing." peterlazaroff.com) Morgan Housel on what our brains really want. axios.com) How a CD ladder works.

Alpha Architect

APRIL 7, 2025

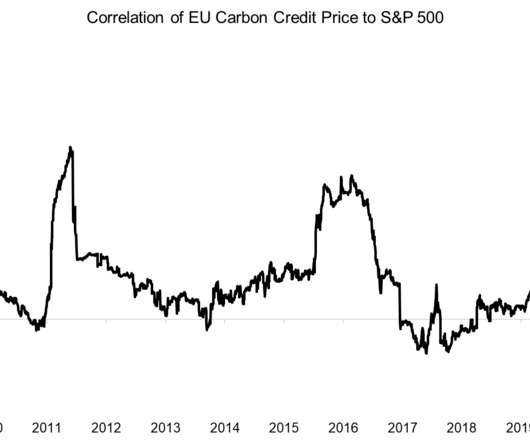

This has critical implications for portfolio construction and risk management. With over nearly 150 years of data, the study finds that when inflation and interest rates rise, stocks and bonds tend to move together, reducing diversification benefits. Please read the Alpha Architect disclosures at your convenience.

Yardley Wealth Management

JANUARY 21, 2025

With the complexity of modern financial decisions and the abundance of online resources, you might wonder if speaking with a financial planner is truly worth the investment. Investment Management Is talking to a financial planner worth it for investment guidance?

Risk Management Guru

SEPTEMBER 29, 2022

In the stock market, risk management is locating, quantifying, and dealing with the various risks that can affect investment. Due to the potential negative effects of various risks on a person’s investment portfolio, effective risk management is crucial.

The Big Picture

MARCH 22, 2023

fivethirtyeight ) Be sure to check out our Masters in Business this week with Cliff Asness, co-founder and chief investment officer at AQR Capital Management. The quant firm manages $100 billion in 40 diversified strategies across equity and alternatives, applying mathematics to market data and making evidence-based investments.

Abnormal Returns

APRIL 15, 2024

mrzepczynski.blogspot.com) Don't let one mistake keep your from investing over the long run. awealthofcommonsense.com) Finance The CBOE's ($CBOE) defense of 0DTE options as risk management tool. Strategy Even the best investors make big mistakes. bestinterest.blog) Big winners require patience.

Validea

JUNE 2, 2025

Instead, it’s built to perform reasonably well across a wide range of market conditionsand more importantly, to help investors stay invested during turbulent times.

Norman Marks

APRIL 2, 2025

When I think about risk management and the business I usually have the perspective of a business leader. Maybe thats because by the time I was leading a risk management function, I was already a vice president and working with the executive management team.

Trade Brains

NOVEMBER 3, 2024

The company’s disciplined lending practices and strong risk management contribute to its market leadership. Advanced risk management systems enhance portfolio quality and stability, while strategic partnerships accelerate market penetration and business growth. Investing in equities poses a risk of financial losses.

Nerd's Eye View

MARCH 8, 2024

Also in industry news this week: A recent survey has found that a majority of prospective financial planning clients across all age brackets are open to working with a remote advisor, creating opportunities for advisors to grow their businesses and for clients to find the ‘best’ advisor for their needs, regardless of their location A federal (..)

Validea

MARCH 31, 2025

Drawing from two insightful interviews with Schwager, they explore key lessons from some of the greatest traders hes interviewed, like Paul Tudor Jones and Steve Cohen, and unpack how these principles apply not only to trading but also to long-term investing and life.

Validea

DECEMBER 20, 2024

” Bob breaks down how these complex investment vehicles work, discussing their unique structure where multiple portfolio managers operate independently while sharing infrastructure and risk management resources.

Trade Brains

JUNE 13, 2025

Société Générale is one of Europe’s leading financial services groups, offering a wide range of banking, investment, and financial solutions. Headquartered in Paris, it operates globally across retail banking, corporate and investment banking, asset management, and securities services. With a market capitalization of Rs 2.40

Abnormal Returns

DECEMBER 11, 2022

Top clicks this week Nick Maggiulli's favorite investment writing of 2022. novelinvestor.com) Louis Sykes, "Some of the most intelligent and sophisticated traders on the planet lost everything in this market because they let ego get in the way of judgment and sound risk management processes." ritholtz.com) Bond lingo, 101.

Carson Wealth

JANUARY 8, 2025

They consider your current financial situation, risk tolerance, and future objectives to help develop a comprehensive plan. Behavioral Guidance and Emotional Support Investing often involves emotional decision-making, which can lead to impulsive actions during market volatility. The post Why Should I Hire a Financial Advisor?

Brown Advisory

SEPTEMBER 6, 2022

Investing for Purpose: A Governance Perspective on Mission-Aligned Investment Strategy. Increasingly, investment committee members are exploring mission-aligned investing for the organizations they serve. DEFINING MISSION-ALIGNED INVESTING. Tue, 09/06/2022 - 10:17.

WiserAdvisor

JUNE 16, 2025

While you are busy earning, investing, and scaling your income, it is easy to overlook the importance of protecting what you have already built. With the right high-net-worth investing strategies, you can keep your wealth intact without turning your life upside down. Making sure it lasts, not just your lifetime but also after you.

Advisor Perspectives

MAY 13, 2025

” Greg Behar of Westwood’s Managed Investment Solutions (MIS) team examines how the Russell U.S. Indexes’ decision to return to a semi-annual reconstitution schedule is transforming risk management practices, market participation and the future of custom indexing.

Nerd's Eye View

JANUARY 22, 2024

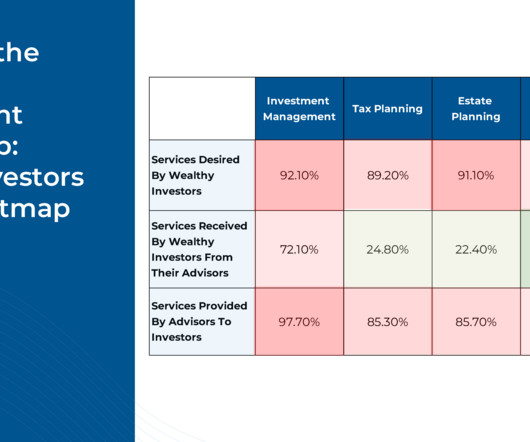

For example, an advisor may think of "risk management" in terms of life and property insurance coverage, whereas HNW clients may instead think of tax and estate-planning strategies as asset protection measures – particularly for the future wealth of their heirs.

Validea

FEBRUARY 18, 2025

Through selected clips from multiple interviews, they unpack Karsan’s unique insights on markets, investing, and risk management.

Advisor Perspectives

MARCH 20, 2025

On March 11, Russell Investments hosted a webinar examining the challenges and opportunities presented by alternative diversifiers, including strategies for incorporating these solutions into portfolios.

Validea

NOVEMBER 2, 2024

In a wide-ranging conversation on the Excess Returns podcast, renowned investor Guy Spier shared valuable insights about investing, personal growth, and learning from mistakes. Align Your Inner and Outer Self Spier highlighted the importance of authenticity in investing and business.

WiserAdvisor

JUNE 13, 2025

In this article, we’ll walk through some of the most common investment mistakes retirees make. By understanding these risks now, you can make smarter choices, protect what you’ve built, and feel more confident about your financial future. Mistake #3: Not keeping emotions out of investing Emotions and investing don’t mix well.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content