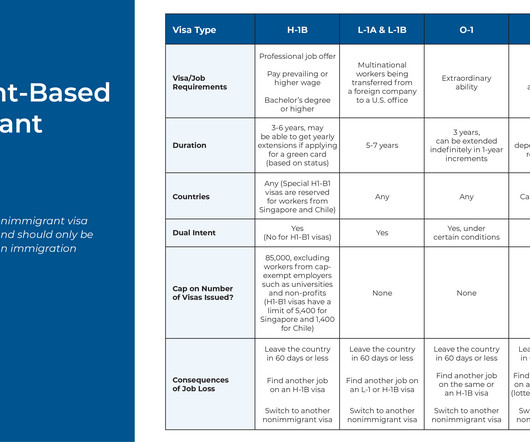

Investing For Nonimmigrant Visa Holders: Understanding Visa Types, Investment Challenges, And Tax Implications

Nerd's Eye View

MAY 17, 2023

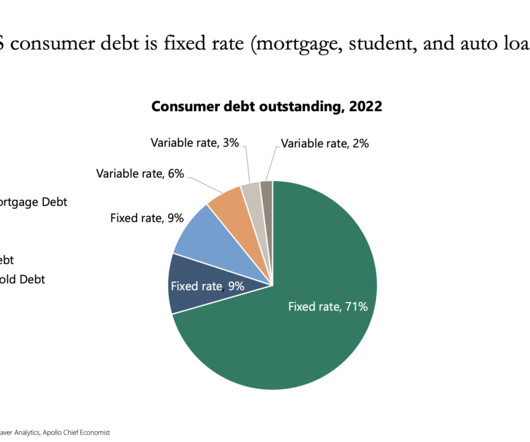

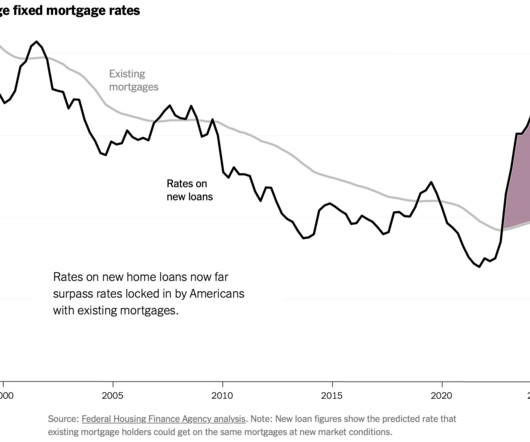

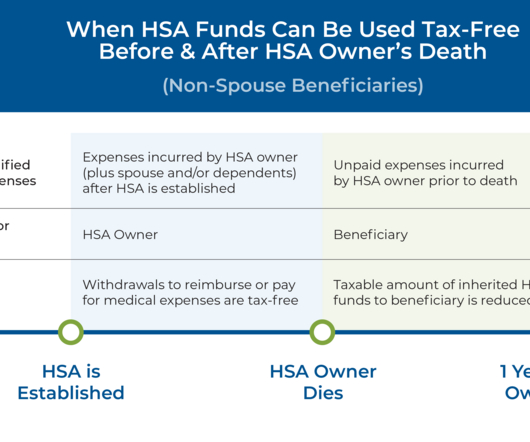

Like native-born workers, foreign workers need to think about saving for retirement, planning for their children’s college, managing healthcare costs, and all manner of other financial goals. For example, the tax benefits of certain accounts can sometimes work in the other direction if a non-U.S.-born

Let's personalize your content