Does International Diversification Work?

Alpha Architect

FEBRUARY 28, 2023

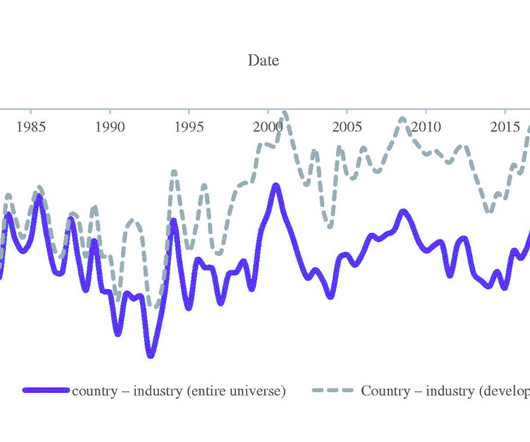

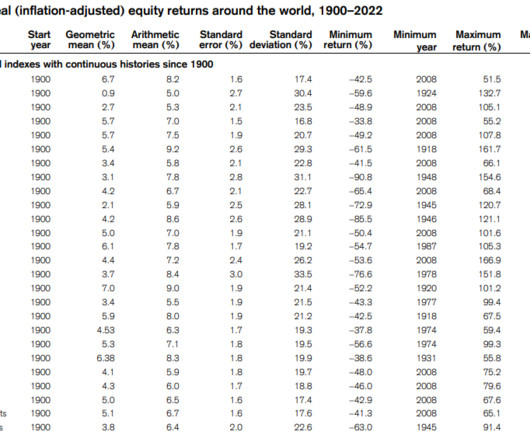

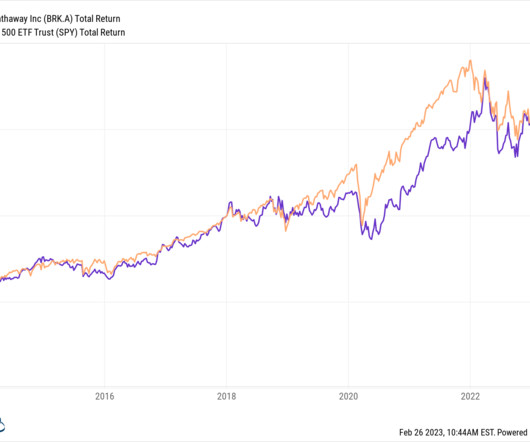

In this article, the authors examine the research on the benefits of international diversification. Some argue that because equity markets generally crash simultaneously, there are no benefits to having equity diversification. The evidence from this paper rejects this hypothesis. Does International Diversification Work? was originally published at Alpha Architect.

Let's personalize your content