Tony Bennett’s Children Embroiled in Lawsuit Over His Estate

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

Wealth Management

JULY 3, 2024

Tony Bennett's two daughters accuse their brother of mishandling their late father’s assets

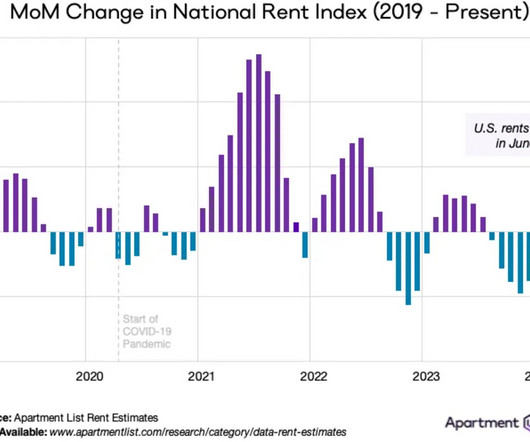

Calculated Risk

JULY 2, 2024

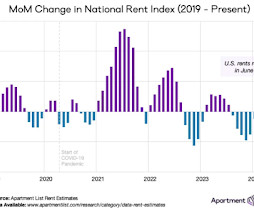

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year Brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

JULY 5, 2024

Economy Paul Podolsky talks with Lev Borodovsky, creator of The Daily Shot. (paulpodolsky.substack.com) Tyler Cowen talks with Joseph Stiglitz, author of "The Road to Freedom: Economics and the Good Society." (conversationswithtyler.com) Roben Farzad talks with Hal Hodson about the mind-boggling solar revolution. (pod.link) Alternatives Eric Golden talks with Phil Huber, Head of Portfolio Solutions at Cliffwater, about the case for private credit.

Nerd's Eye View

JULY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that a recent U.S. Supreme Court decision shifting authority to interpret laws passed by Congress from Federal agencies to the judicial system could have significant impacts on regulation of the financial advice industry, including the potential for additional legal challenges to regulations from the Securities and Exchange Commission (SEC), the Department of Labor (DoL), and o

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

JULY 5, 2024

On the Foundation for Research on Equal Opportunity website, advisors and clients can search for the ROI of individual programs offered by private and state colleges and universities.

Calculated Risk

JULY 3, 2024

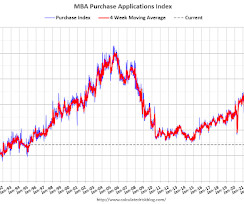

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 28, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Nerd's Eye View

JULY 1, 2024

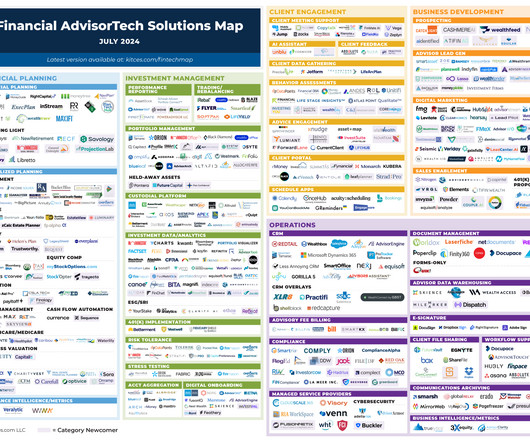

Welcome to the July 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors! This month's edition kicks off with the news that AI meeting support solution Jump has raised $4.6 million in venture capital, as meeting support has increasingly shown itself as a leading use case for AI as it applies to financial advisors given the s

Wealth Management

JULY 5, 2024

If your only differentiator is that you charge 75 basis points, you’ll likely lose the battle when the advisor across town drops to 50.

Calculated Risk

JULY 5, 2024

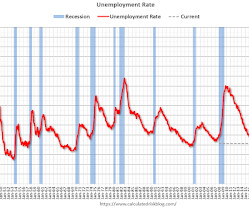

From the BLS: Employment Situation Total nonfarm payroll employment increased by 206,000 in June , and the unemployment rate changed little at 4.1 percent , the U.S. Bureau of Labor Statistics reported today. Job gains occurred in government, health care, social assistance, and construction. The change in total nonfarm payroll employment for April was revised down by 57,000, from +165,000 to +108,000, and the change for May was revised down by 54,000, from +272,000 to +218,000.

Abnormal Returns

JULY 3, 2024

Strategy Politics and investing don't mix. (howardlindzon.com) Good luck trying to time market factors. (rogersplanning.blogspot.com) Not all investment decisions are created alike. (behaviouralinvestment.com) Finance A lot of loans got repriced in 2024, so far. (axios.com) What former Vanguard OCIO clients should expect. (blogs.cfainstitute.org) Startups Half of VC funding in Q2 went to AI-related startups.

Speaker: Kim Beynon, CPA, CGMA, PMP

The most overlooked, yet most critical, element of transformation is preparing people for change. Automation and AI aren't just technical upgrades, they’re cultural shifts which can challenge identities. That’s why change management isn’t a side project—it’s the foundation. In finance, where precision and process rule, navigating change can feel especially disruptive.

Nerd's Eye View

JULY 2, 2024

Welcome everyone! Welcome to the 392nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Kristopher Heck. Kristopher is a Founding Partner of Tanager Wealth Management, an RIA based in London, England, that oversees approximately $1.1 billion in assets under management (AUM) for 630 client households. What's unique about Kristopher, though, is how his firm has scaled to more than a billion dollars of AUM while specializing in working with clients whose personal an

Wealth Management

JULY 1, 2024

Last week, the Court ruled that the commission’s use of in-house administrative law judges violated the Constitution’s guarantee of a jury trial in certain cases. That may change the landscape for financial advisors defending themselves against SEC charges and civil penalties.

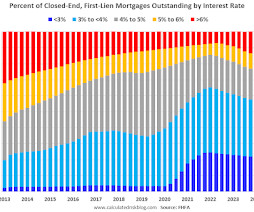

Calculated Risk

JULY 1, 2024

Today, in the Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding Mortgage Rates, LTV and Credit Scores A brief excerpt: Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q4 2023 (released this morning).

Abnormal Returns

JULY 2, 2024

Markets It's been awhile since we had a 1% drop in the S&P 500. (cautiouslyoptimist.com) Even when the stock market is up YTD there are plenty of stocks that are down on the year. (awealthofcommonsense.com) Putting the growth in private credit into some perspective. (apolloacademy.com) Fund management Hedge funds have a size problem. (bloomberg.com) A great reminder that index construction matters.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Nerd's Eye View

JULY 3, 2024

Over the past few decades, technological advances and plummeting transaction costs have facilitated the emergence of a dizzying variety of ways to gain exposure to very specific areas of the market. As a result, advicers have more options than ever to add value for their clients by tailoring investment portfolios that are specific to their unique needs, goals, and risk tolerance.

Wealth Management

JULY 2, 2024

Dangers abound when wealth enterprises celebrate founders over advisors.

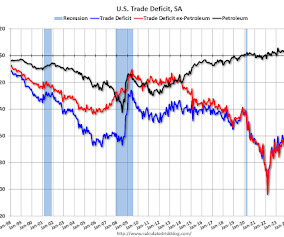

Calculated Risk

JUNE 29, 2024

The key report scheduled for this week is the June employment report to be released on Friday. Other key reports include the June ISM Manufacturing survey, June Vehicle Sales and the Trade Deficit for May. -- Monday, July 1st -- 10:00 AM: ISM Manufacturing Index for June. The consensus is for the ISM to be at 49.0, up from 48.7 in May. 10:00 AM: Construction Spending for May.

Abnormal Returns

JULY 4, 2024

Books An excerpt from "Unit X: How the Pentagon and Silicon Valley Are Transforming the Future of War" by Raj Shah and Christopher Kirchhoff. (theatlantic.com) A Q&A with Soraya Chemaly, author of "The Resilience Myth: New Thinking on Grit, Strength, and Growth After Trauma." (annehelen.substack.com) Insights from “Holding it Together: How Women Became America’s Safety Net,” by Jessica Calarco (crr.bc.edu) Business Shareholder supremacy explains a lot of the dysfunction and grifting around u

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Carson Wealth

JULY 3, 2024

Running a small business involves juggling multiple responsibilities. Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Here are eight essential financial tips for small business owners to help ensure long-term success. 1.

Wealth Management

JULY 5, 2024

Retirement industry thought leaders answer three probing questions on critical issues, providing an open, honest and candid dialogue.

Calculated Risk

JULY 2, 2024

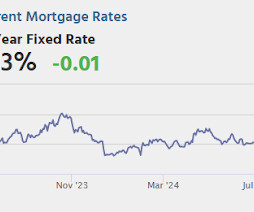

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:15 AM, The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in June, up from 152,000 in May. • At 8:30 AM, The initial weekly unemployment claims report will be released.

Abnormal Returns

JULY 3, 2024

Podcasts Barry Ritholtz talks with Peter Mallouk about keeping things simple. (ritholtz.com) Christine Benz and Jeff Ptak talk with Scott Burns about financial minimalism. (morningstar.com) Steve Chen talks with Andrew Biggs about whether there really is a retirement crisis brewing in the U.S. (podcasts.apple.com) Katie Gatti Tassin on whether you are saving too much for retirement.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

A Wealth of Common Sense

JULY 2, 2024

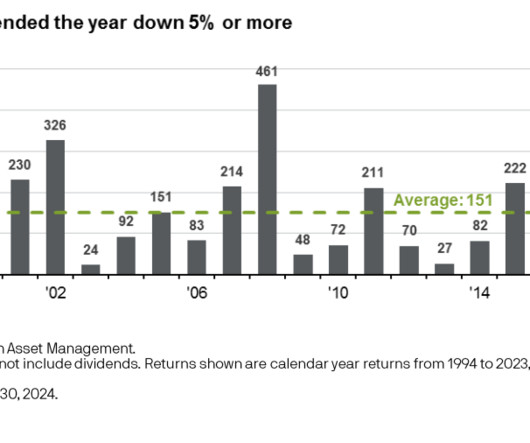

Halfway through the year, the S&P 500 was up 15.3%, including dividends. Despite these impressive gains the bull market has been relatively boring this year. There have been just 14 trading days with gains of 1% or more. There has been just a single 2% up day in 2024. And there have only been 7 days of down 1% or worse. Small moves in both directions.

Wealth Management

JULY 2, 2024

The U.S. has a major spending problem which neither political party seems willing to address.

Calculated Risk

JUNE 29, 2024

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • New Home Sales Decrease to 619,000 Annual Rate in May • Case-Shiller: National House Price Index Up 6.3% year-over-year in April • Inflation Adjusted House Prices 2.3% Below Peak • Watch Months-of-Supply! • Freddie Mac House Price Index Increased in May; Up 5.9% Year-over-year This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Abnormal Returns

JULY 1, 2024

Markets How major asset classes performed in June 2024. (capitalspectator.com) Large caps trounced mid and small-caps in June 2024. (on.spdji.com) Momentum leads the factor race in 2024 YTD. (insights.finominal.com) Trading 24-hour stock trading is gaining popularity. (bloomberg.com) Why single-stock oDTE could be next in line to take off. (barrons.com) Robinhood ($HOOD) is buying the AI-research platform Pluto Capital Inc.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

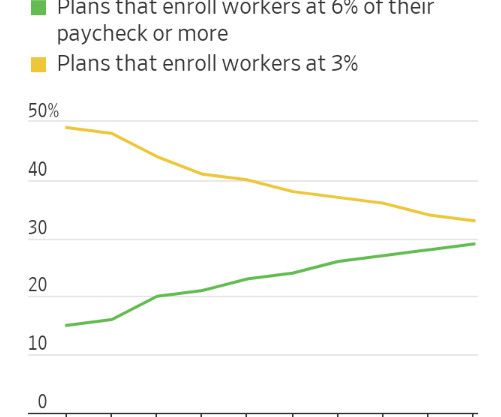

A Wealth of Common Sense

JULY 5, 2024

My personal finance pipedream for America is that we adopt something like Australia’s retirement system where workers are forced to save a certain percentage of their income for retirement. That pipedream will never happen because Americans hate being forced to do anything. You need to make people think that saving for retirement is their idea.

Wealth Management

JULY 3, 2024

Without proper guidance regarding taxes, philanthropy and estate planning, high net worth entrepreneurs can miss opportunities.

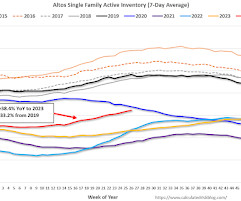

Calculated Risk

JULY 1, 2024

Altos reports that active single-family inventory was up 1.8% week-over-week. Inventory is now up 30.7% from the February seasonal bottom, and at the highest level since July 2020. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of June 28th, inventory was at 646 thousand (7-day average), compared to 634 thousand the prior week.

Abnormal Returns

JULY 1, 2024

Podcasts Amy Arnott and Christine Benz talk with Don Graves and Wade Pfau about the role of home equity in retirement planning. (morningstar.com) Frazer Rice talks with Justin Elliott of ProPublica about how a $5 billion Roth IRA came to be. (frazerrice.com) The biz How Altruist makes money. (blog.altruist.com) After splitting with Sanctuary Wealth, Jim Dickson has co-founded Elevation Point, an RIA platform services business and investor.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content