Stock Market Highs and Your Retirement

The Chicago Financial Planner

NOVEMBER 8, 2021

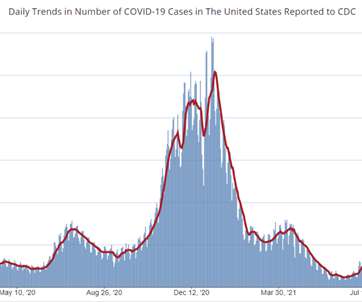

After a significant drop in March of 2020 in the wake of the pandemic, the S&P 500 has staged an amazing recovery. The index finished 2020 with a gain in excess of 18%. So far in 2021, the index is in record territory and has closed at record levels numerous times during the year. At some point we are bound to see a stock market correction of some magnitude, hopefully not on the order of the 2008-09 financial crisis.

Let's personalize your content