Housing October 17th Weekly Update: Inventory Increased, New High for 2022

Calculated Risk

OCTOBER 17, 2022

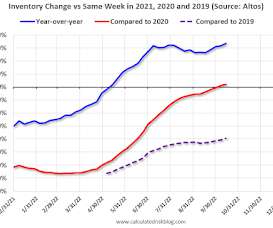

Active inventory increased again, hitting a new peak for the year. Here are the same week inventory changes for the last four years ( usually inventory is declining at this time of year ): 2022: +5.0K 2021: -2.4K 2020: -0.9K 2019: -10.9K Inventory bottomed seasonally at the beginning of March 2022 and is now up 135% since then. Altos reports inventory is up 33.7% year-over-year.

Let's personalize your content