Client Estate Plan Review Checklist

Wealth Management

SEPTEMBER 7, 2023

Twenty points to help ensure your clients' legacies stay on track.

Wealth Management

SEPTEMBER 7, 2023

Twenty points to help ensure your clients' legacies stay on track.

Calculated Risk

SEPTEMBER 7, 2023

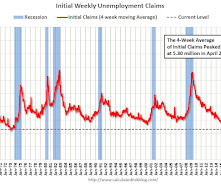

The DOL reported : In the week ending September 2, the advance figure for seasonally adjusted initial claims was 216,000 , a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 228,000 to 229,000. The 4-week moving average was 229,250, a decrease of 8,500 from the previous week's revised average.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 7, 2023

Also, GMO’s Nebo passes $1B in platform assets a year after launching, Finology Software’s website is now live and Focus Financial Partners is UPTIQ’s newest client.

Calculated Risk

SEPTEMBER 7, 2023

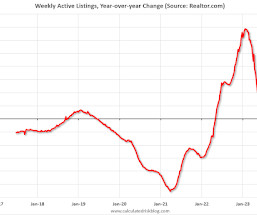

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report from Sabrina Speianu and Danielle Hale: Weekly Housing Trends View — Data Week Ending Sep 2, 2023 • Active inventory declined, with for-sale homes lagging behind year ago levels by 5.2%. This past week marked the 11th consecutive decline in the number of homes actively for sale compared to the prior year, however the gap narrowed slightly compared to the previous week’s -5.9% figure.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

SEPTEMBER 7, 2023

Tips for improving networking skills include watching body language and being authentic.

Abnormal Returns

SEPTEMBER 7, 2023

Strategy It's hard to overstate the impact of the big tech stocks on the U.S. stock market of late. (theirrelevantinvestor.com) Big tech stocks have their own valuation experience. (wisdomtree.com) Big Tech has messed with factor investors. (advisorperspectives.com) Finance Blackstone ($BX) was early on the AI trend. (institutionalinvestor.com) Should you buy what Softbank is selling, i.e.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 7, 2023

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in August A brief excerpt: This is the first look at several early reporting local markets in August. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Wealth Management

SEPTEMBER 7, 2023

In an active recruiting environment, advisors are eager to understand where deals are at and where they’re headed. Beyond a transition deal, how can advisors monetize their business over time—thinking about the short-, mid- and long-term—whether they are in an employee or independent model?

Nerd's Eye View

SEPTEMBER 7, 2023

A recent McKinsey report surveying growth in the wealth management industry predicted that the struggles of small RIA firms would increase as larger firms continue to grow and overshadow the industry. again. Although the messaging that smaller RIAs must scale to survive has been offered many times before over the past few decades, many smaller lifestyle firms and solo RIA practices have thrived in their preference to stay small.

Wealth Management

SEPTEMBER 7, 2023

Advisors are on the move this week, as no fewer than three teams announced they're switching platforms

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Calculated Risk

SEPTEMBER 7, 2023

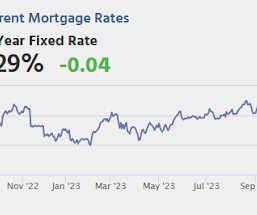

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 12:00 PM ET, Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Wealth Management

SEPTEMBER 7, 2023

A discussion about mergers and acquisitions and how effective technology and workflow management will drive a new wave of growth in the advice industry.

Calculated Risk

SEPTEMBER 7, 2023

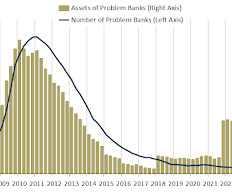

The FDIC released the Quarterly Banking Profile for Q2 2023: Reports from 4,645 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $70.8 billion in second quarter 2023. Though second-quarter net income decreased by $9.0 billion (11.3 percent) from first quarter 2023, after excluding the effects on acquirers‘ incomes of their acquisition of three failed banks in 2023, quarter-over-quarter net income would have been

Wealth Management

SEPTEMBER 7, 2023

In the wake of its acquisition of SVB Private, Michael Wilson will now lead the combined wealth management division.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

SEPTEMBER 7, 2023

Final Trades: Oracle, Zoom, Berkshire Hathaway & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

SEPTEMBER 7, 2023

The ARK 21Shares Ethereum ETF would be the first of its kind and, if offered, would mark the first US exchange-traded fund that’s physically backed by the second-largest cryptocurrency after Bitcoin.

The Big Picture

SEPTEMBER 7, 2023

My morning train WFH reads: • The Generational Paradigm Shift Taking Over Markets : For most of the 20th century, stocks and bond yields moved in opposite directions. They’re doing it again after a two-decade break. ( Wall Street Journal ) • How Tiger Global, one of the biggest backers of startups over the past decade, fell to earth : As the firm grew, Tiger prioritized speed and began writing checks at a more rapid clip.

A Wealth of Common Sense

SEPTEMBER 7, 2023

A reader asks: My job is to run a concentrated 20 company portfolio (all listed companies, buy and hold, long term horizon etc.). I get a base salary and a bonus for performance. So a good amount of my annual earnings are tied to the performance of the companies I pick. I also have a small personal investment account. My question is around how I should think about investing this – should I use the fact that I spend.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

The Irrelevant Investor

SEPTEMBER 7, 2023

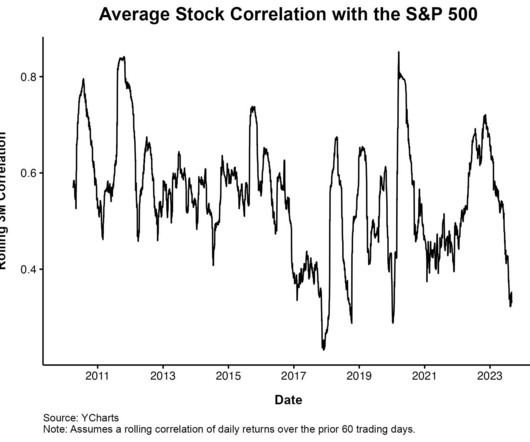

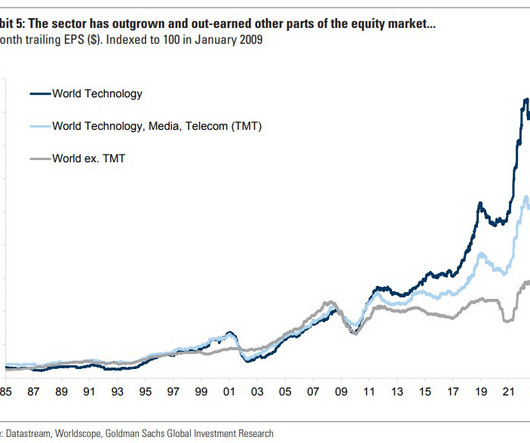

Technology moves the world forward. For the past decade, it’s done the same thing for the stock market. A lot of time was spent debating if the Fed drove these stocks higher with low interest rates. Another theory is that investors are just chasing returns. And yet another is that index funds are making the big stocks even bigger. Bits and pieces of these theories may be true, but the simplest and best explanation a.

Fintoo

SEPTEMBER 7, 2023

Highlights Issue Size – 15,224,923 shares Issue Open/Close – Sept 08 /Sept 12, 2023 Price Band (Rs.) 200 – 211 Issue Size- 3,212 mn Face Value (Rs) 10 Lot Size (shares) 70 EMS Ltd. incorporated in 2010 is in the business of (i) Sewerage solution providers (ii) Water Supply Systems (iii) Water and Waste Treatment […] The post EMS LIMITED IPO (Subscribe) appeared first on Fintoo Blog.

Trade Brains

SEPTEMBER 7, 2023

Countries That Have Changed Their Names : India is currently in a controversial debate over a name change to ‘Bharat’, sparked by the official G20 dinner invitation from the ‘President of Bharat’ instead of the ‘President of India.’ This is the first time an official invitation has mentioned a change in India’s name. All eyes are on the upcoming special 5-day session of Parliament from September 18.

Million Dollar Round Table (MDRT)

SEPTEMBER 7, 2023

By Matt Pais, MDRT Content Specialist For his best clients, 14-year MDRT member Mark Neufeld, CFP , of Vancouver, British Columbia, Canada, offers to serve as a “sounding board” for their friends and family. Sometimes clients have people in their lives who have questions about the financial world. “I will be happy to invest an hour of my time, bring them into the office, sit down with them and see if I can help them.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Alpha Architect

SEPTEMBER 7, 2023

The following factor performance modules have been updated on our Index website.[ref]free access for financial professionals[/ref] Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads Global Factor Performance: September 2023 was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Clever Girl Finance

SEPTEMBER 7, 2023

In personal finance, where income, expenses, dreams, and aspirations converge, the budget emerges as a crucial tool. It’s not just a set of numbers, rather, it’s a strategic plan that empowers you to navigate the complexities of financial decisions. And when you have a family, creating a family budget becomes even more important. Table of contents What is a family budget?

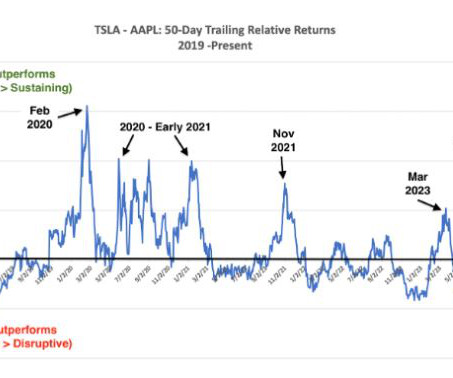

The Irrelevant Investor

SEPTEMBER 7, 2023

Today’s Compound and Friends is brought to you by GraniteShares: See here for more information on GraniteShares’ suite of short and leveraged single-stock ETFs. On today’s show, we discuss: Earnings insights through Q2 Techs broken promises Listen here: Charts: Tweets: Okay, in these now-famous charts comparing $TSLA's fundamentals and market cap to other automakers, I have exc.

Darrow Wealth Management

SEPTEMBER 7, 2023

Is exercising stock options right before a company goes public a good idea? Employees with pre-IPO incentive or non-qualified stock options often wonder if they should exercise before the company goes public (perhaps during a final open window) or wait until after the IPO. Assuming you have the cash on hand to fund it (more on that later), it can be a difficult question to answer as we’ll only know in hindsight (after seeing how the stock performs) whether exercising before the IPO was a g

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

SEPTEMBER 7, 2023

Let's take a close look at August's employment report numbers on Full and Part-Time Employment. The latest data shows that 83.2% of total employed workers are full-time (35+ hours) and 16.

Random Roger's Retirement Planning

SEPTEMBER 7, 2023

A few months ago we looked at the then new Return Stacked Bonds & Managed Futures ETF (RSBT). The simplest take on return stacking is to use leverage in a fund to blend exposures that tend to have a low or negative correlation to each other. Done in that manner, it comes close to leveraging down to create a better risk adjusted result and possibly a better nominal result too.

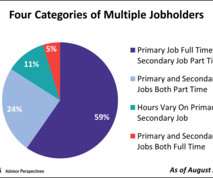

Advisor Perspectives

SEPTEMBER 7, 2023

Multiple jobholders account for 4.8% of civilian employment. The survey captures data for four subcategories of the multi-job workforce, the relative sizes of which we've illustrated in a pie chart.

Discipline Funds

SEPTEMBER 7, 2023

This was a really fun interview I recently did with Jack Forehand and Justin Carbonneau of Validea Capital. This is one of the first times (maybe the first time ever?) where I’ve laid out my overarching methodology and process for thinking about asset allocation. We covered a huge amount of ground here in an hour. I hope you learn something new from this interview. 02:32 – Cullen’s goals with his personal portfolio 04:50 – Matching the duration of assets with liabilities

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content