The Top 5 ESG Mistakes Advisors Make

Wealth Management

JANUARY 24, 2023

More clients want it than you might think, and it need not be as hard as it seems.

Wealth Management

JANUARY 24, 2023

More clients want it than you might think, and it need not be as hard as it seems.

Nerd's Eye View

JANUARY 24, 2023

Welcome back to the 317th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Jennifer Climo. Jennifer is the CEO and a Senior Advisor for Milestone Financial Planning, an independent RIA based in Bedford, New Hampshire, that oversees $360 million in assets under management for 225 client households. What's unique about Jennifer, though, is how, after more than a decade of building her own successful solo practice, she intentionally decided to merge her practice wit

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JANUARY 24, 2023

What's driving RIA valuations? These factors are what smart buyers look for, and smart sellers keep in mind at all times, says Dynasty's CEO.

The Reformed Broker

JANUARY 24, 2023

Final Trades: Live Nation, Chevron, Citigroup and more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

JANUARY 24, 2023

It may be time for wealth management firms to adjust fees, take that crypto course and hire a junior advisor, according to a new Fidelity report.

Abnormal Returns

JANUARY 24, 2023

Markets We are in the strongest part of the Presidential election cycle. (allstarcharts.com) Why value stocks can outperform for a while. (mailchi.mp) Strategy Don't let any investment become your identity. (youngmoney.co) Why it's so hard not to tinker with your investment process. (behaviouralinvestment.com) Companies The DOJ has filed suit against Google ($GOOGL) over online advertising.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

JANUARY 24, 2023

From the BLS: Regional and State Employment and Unemployment Summary Unemployment rates were higher in December in 7 states, lower in 5 states, and stable in 38 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Thirty-five states and the District had jobless rate decreases from a year earlier, 4 states had increases, and 11 states had little change.

Wealth Management

JANUARY 24, 2023

The broker/dealer business is starting to embrace different models and affiliation options.

Pragmatic Capitalism

JANUARY 24, 2023

1) The Competition for Worst Ideology is Heating Up There’s a battle of bad ideologies going on around the debt ceiling debate.

Wealth Management

JANUARY 24, 2023

Exclusive WMRE research shows that owners of office buildings do not see positive prospects for occupancy or rental growth.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

JANUARY 24, 2023

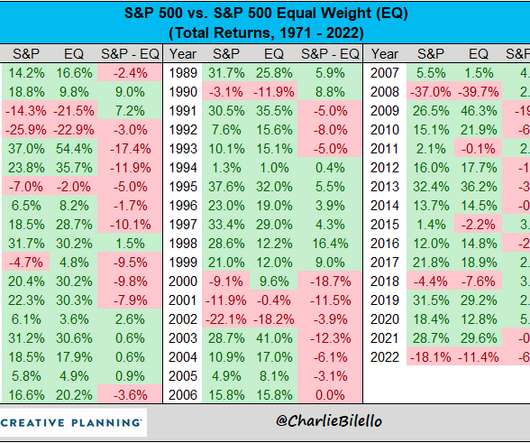

Private equity Allocators need better models to value their private holdings. (institutionalinvestor.com) It's hard to pencil out strong private equity returns moving forward. (alphaarchitect.com) Factors The case for diversifying away from the market factor. (alphaarchitect.com) No matter how you define growth, those stocks have been a disappointment over the past two decades.

Wealth Management

JANUARY 24, 2023

The new product provides firms with account aggregation and multi-custodial feeds through a single API.

A Wealth of Common Sense

JANUARY 24, 2023

One of the strange things about growing older is you begin to realize how much your place in life determines your taste in entertainment. There are movies and TV shows that stand the test of time but there are also many that hold a special place in your heart simply because you watched them at a certain age. There are movies that I loved as a little kid that I probably wouldn’t relate to as much today.

Wealth Management

JANUARY 24, 2023

Putting a new conservation easement case into perspective.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Calculated Risk

JANUARY 24, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • During the day, The AIA's Architecture Billings Index for December (a leading indicator for commercial real estate).

Wealth Management

JANUARY 24, 2023

One piece of legislation that provides a wide range of benefits for new and existing investors as well as ample opportunities for financial advisors.

The Reformed Broker

JANUARY 24, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►MSFT Earnings – “Microsoft’s Earnings Are Coming. 2 Major Issues Hang Over the Stock.” ►Is the Bear Market Over? – “The current bear has now reached the depth and duration of a normal no.

Wealth Management

JANUARY 24, 2023

Propmodo draws attention to growing withdrawal requests from open-end diversified core equity funds. Dollar General to start operating mobile health clinics, reports Chain Store Age. These are among today’s must reads from around the commercial real estate industry.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

JANUARY 24, 2023

Today, in the Calculated Risk Real Estate Newsletter: Final Look at Local Housing Markets in December A brief excerpt: The big story for December existing home sales was the sharp year-over-year (YoY) decline in sales. Another key story was that new listings were down further YoY in December as many potential sellers are locked into their current home (low mortgage rate).

Wealth Management

JANUARY 24, 2023

Zephyr Market Strategist Ryan Nauman looks at some of the noteworthy market dynamics that played out during the tumultuous 2022.

Good Financial Cents

JANUARY 24, 2023

The Roth IRA vs traditional IRA – they’re basically the same plan, right? Not exactly. While they do share some similarities, there are enough distinct differences between the two where they can just as easily qualify as completely separate and distinct retirement plans. To clear up the confusion between the two, let’s look at where Roth IRAs and traditional IRAs are similar, and where they’re different.

Wealth Management

JANUARY 24, 2023

The exact role of estate planners may be difficult to define.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

The Irrelevant Investor

JANUARY 24, 2023

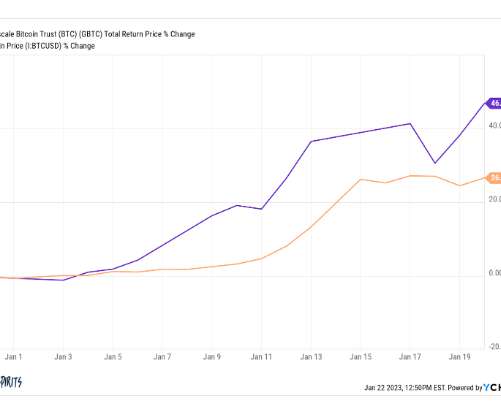

Today’s Animal Spirits is brought to you by YCharts: Enter your information here to get 20% off YCharts (new clients only) On today’s show, we discuss: The narrative vortex December 2022 retail sales Auto market weekly summary: January 13 Tesla’s price cuts are roiling the car market Over 5M new US startups show Covid-era boom has legs Google laid off high performers and earners while largely sparing ̵.

Wealth Management

JANUARY 24, 2023

Deciphering the lessons of 2022 by examining the performance of three tail-risk hedging strategies.

Nationwide Financial

JANUARY 24, 2023

After a decade of muted price gains, inflation fears have cropped up again as the costs of many goods and services have spiked this year. The ongoing pandemic has played a leading role in the jump in inflation as lingering COVID-induced supply chain disruptions have made it difficult to find some items while driving up consumer prices. Predicting future inflation can be difficult as current readings only reflect where prices have been trending rather than where they are headed.

Wealth Management

JANUARY 24, 2023

Get help recognizing and diagnosing potential issues.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

JANUARY 24, 2023

Two major issues clients should consider in creating their own long-term care plan are where they will live and how they will pay for the care they are likely to need.

Wealth Management

JANUARY 24, 2023

How reframing handoffs exponentially expands your firm’s capabilities.

Million Dollar Round Table (MDRT)

JANUARY 24, 2023

By Thomas F. Levasseur, CLU, MS Ed. I’ve been an MDRT member for more than 30 years. During that time, I’ve served on numerous committees and task forces where I got to rub elbows with great leaders. From those experiences, I’ve found that an important part of life is seeking to serve, not to shine. The desire to shine can cause you to get in your own way.

Wealth Management

JANUARY 24, 2023

Four thought leaders provide their insights into the future of the modern estate-planning practice.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content