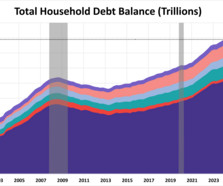

NY Fed Q2 Report: Household Debt Increased, Mortgage Originations Remain Low

Calculated Risk

AUGUST 6, 2024

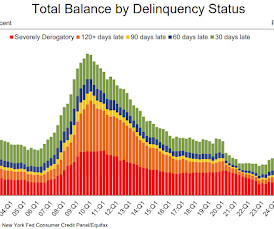

From the NY Fed: Household Debt Increased Moderately in Q2 2024; Auto and Credit Card Delinquency Rates Remain Elevated The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $109 billion (0.6%) in Q2 2024, to $17.80 trillion.

Let's personalize your content