What Else Might be Driving Sentiment?

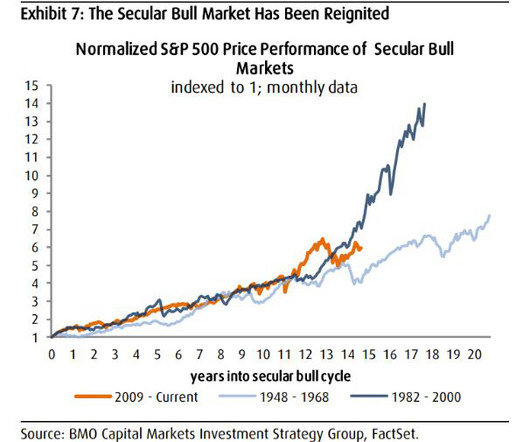

The Big Picture

OCTOBER 19, 2023

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for our clients. I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios. I like to finish with a thought-provoking, often “investing-adjacent” idea they might not have previously considered.

Let's personalize your content