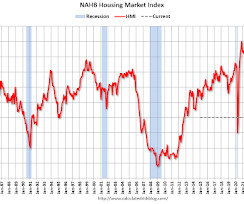

NAHB: "Builder Confidence Levels Indicate Slow Start for Spring Housing Season" in April

Calculated Risk

APRIL 16, 2025

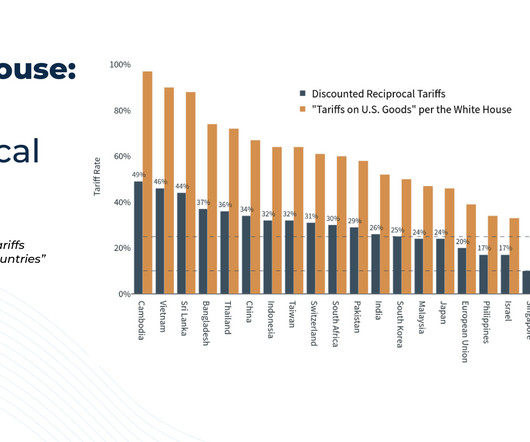

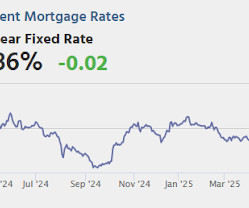

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 40, up from 39 last month. Any number below 50 indicates that more builders view sales conditions as poor than good. From the NAHB: Builder Confidence Levels Indicate Slow Start for Spring Housing Season Growing economic uncertainty stemming from tariff concerns and elevated building material costs kept builder sentiment in negative territory in April , despite a modest bump in confidence likely due t

Let's personalize your content