Dilemmas Faced by Trustees of GST Trusts

Wealth Management

SEPTEMBER 11, 2024

The grantor’s intent is paramount.

Wealth Management

SEPTEMBER 11, 2024

The grantor’s intent is paramount.

Calculated Risk

SEPTEMBER 11, 2024

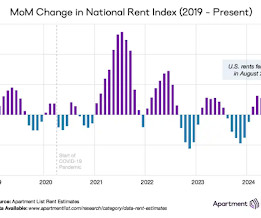

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year Brief excerpt: Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand ).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

SEPTEMBER 11, 2024

Latest lawsuit accuses Johnny’s widow of trademark infringement.

Calculated Risk

SEPTEMBER 11, 2024

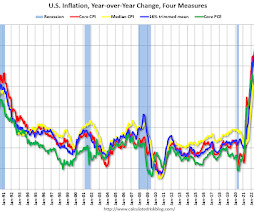

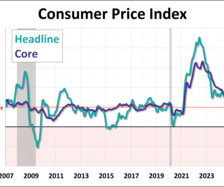

Here are a few measures of inflation: The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined and is now up 4.3% YoY. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through August 2024. Services were up 4.8% YoY as of August 2024, down from 4.9% YoY in July.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

SEPTEMBER 11, 2024

For an upfront purchase price of $50 million, the deal brings $47 billion of assets in the emerging and mid-market retirement plan segments and competitive ESOP administration.

Calculated Risk

SEPTEMBER 11, 2024

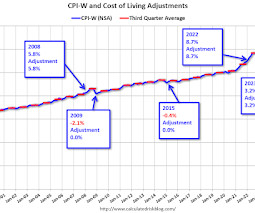

The BLS reported this morning: The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.4 percent over the last 12 months to an index level of 308.640 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment. CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments ), but the current calculation uses the average CPI-W for the three mont

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

SEPTEMBER 11, 2024

The Cleveland Fed released the median CPI and the trimmed-mean CPI. According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in August. The 16% trimmed-mean Consumer Price Index increased 0.2%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Wealth Management

SEPTEMBER 11, 2024

Join David Armstrong as he chats with industry legend Mark Tibergien, winner of the Lifetime Achievement Award at the Wealth Management Industry Awards.

Calculated Risk

SEPTEMBER 11, 2024

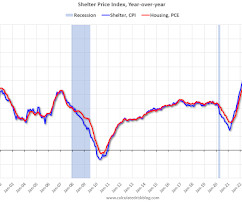

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.5 percent before seasonal adjustment. The index for shelter rose 0.5 percent in August and was the main factor in the all items increase.

Wealth Management

SEPTEMBER 11, 2024

With the election looming, it’s time to reach out to clients and start talking about the implications of sunset.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Calculated Risk

SEPTEMBER 11, 2024

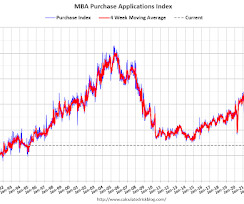

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey Mortgage applications increased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending September 6, 2024. This week’s results include an adjustment for the Labor Day Holiday. The Market Composite Index, a measure of mortgage loan application volume, increased 1.4 percent on a seasonally adjusted basis from one week earlier.

Wealth Management

SEPTEMBER 11, 2024

According to the commission, Donald Anthony Wright made false statements when selling promissory notes to clients to fund the purchase of a Texas-based media marketing company.

Calculated Risk

SEPTEMBER 11, 2024

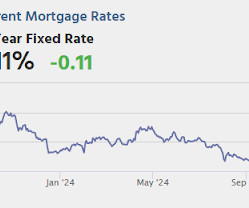

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 227 thousand last week. • At 8:30 AM, The Producer Price Index for August from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI. • At 12:00 PM, Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Wealth Management

SEPTEMBER 11, 2024

The five firms represented by this year's rising stars all saw tangible results as a result of their efforts.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Big Picture

SEPTEMBER 11, 2024

At The Money: Karen Veraa, Head of iShares US Fixed Income Strategy, BlackRock (September 11, 2024) Full transcript below. ~~~ About this week’s guest: Karen Veraa is a Fixed Income Product Strategist within BlackRock’s Global Fixed Income Group focusing on iShares fixed-income ETFs. She supports iShares clients, generates content on fixed-income markets and ETFs, develops new fixed-income iShares ETF strategies, and partners with the iShares team on product delivery.

Discipline Funds

SEPTEMBER 11, 2024

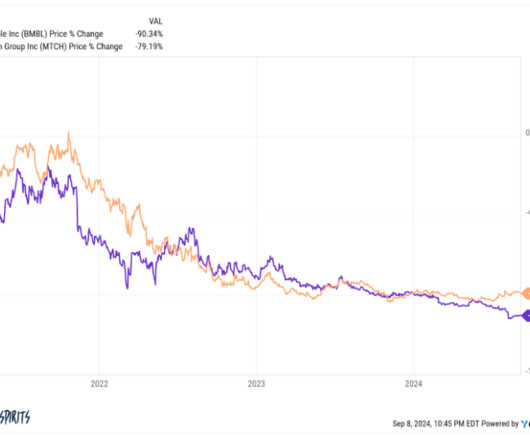

The big question of the week is 25 or 50? No, we’re not talking about the age of Leonardo DiCaprio’s next girlfriend (obviously 25). We don’t have time to think about about girlfriends (or boyfriends) because we’re too busy thinking about Federal Reserve policy and whether they’ll go 25bps or 50bps at the next FOMC meeting.

A Wealth of Common Sense

SEPTEMBER 11, 2024

Today’s Animal Spirits is brought to you by Jensen Investment Management: See here for more information on the Jensen Quality Growth ETF The Compound Podcasts: See here On today’s show, we discuss: The State of America’s Wallet Renting vs. Owning a Home as We Get Older Americans Have a New Piggy Bank to Raid — Their Houses Home Insurance is a Really Big Problem Discount Retailer Big Lots Files f.

Advisor Perspectives

SEPTEMBER 11, 2024

Inflation cooled for a fifth straight month in August, dropping to its lowest level since February 2021. According to the Bureau of Labor Statistics, the headline figure for the Consumer Price Index fell to 2.5% year-over-year, right in line with economist expectations. Additionally, core CPI cooled to 3.2% as expected.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

SEI

SEPTEMBER 11, 2024

We use cookies to collect and analyze information on site performance and usage, and to enhance and customize content and advertising.

Advisor Perspectives

SEPTEMBER 11, 2024

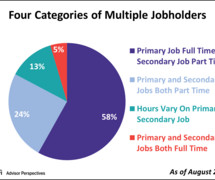

Multiple jobholders account for 5.1% of civilian employment. The survey captures data for four subcategories of the multi-job workforce, the relative sizes of which we've illustrated in a pie chart.

Aleph

SEPTEMBER 11, 2024

Image Credit: Andy Kobel || Remember, the market is mostly a weighing machine, not a voting machine There are three main gripes that I have with respect to the CFA Institute regarding the way they do exams. The exams cost far more than the marginal cost of providing them. CFAI is a nonprofit that acts like a for-profit enterprise. If you are a non-profit, why are you building up so much cash?

Advisor Perspectives

SEPTEMBER 11, 2024

Here’s a quote attributed to P. J. O’Rourke, an American author, journalist and political satirist: “There is a simple rule here, a rule of legislation, a rule of business, a rule of life: beyond a certain point, complexity is fraud.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Trade Brains

SEPTEMBER 11, 2024

Financial metrics are crucial for every company, providing insights into its financial health and performance. Ratios are valuable tools that help assess various aspects of a company’s operations. Among these ratios, the compound annual growth rate (CAGR) stands out as one of the most important. CAGR calculates an investment’s average annual growth rate over a given time frame.

Advisor Perspectives

SEPTEMBER 11, 2024

Let's take a close look at August's employment report numbers on Full and Part-Time Employment. The latest data shows that 82.5% of total employed workers are full-time (35+ hours) and 17.

Random Roger's Retirement Planning

SEPTEMBER 11, 2024

Bespoke Investment Group Tweeted out the following. In the same period, the S&P 500 is up just under 11% so 15% looks pretty good. One big reason I avoid this part of the bond market is that it has equity like beta and I think the 15% gain supports that belief. The other reason is the vacillating correlation to equities. For the last couple of years I've been referring to all of this as unreliable volatility.

Advisor Perspectives

SEPTEMBER 11, 2024

When you pay attention to details in the financial services industry, you elevate your firm’s standing and demonstrate to clients that their relationships are valued. Small, considerate gestures can transform clients’ perception of your service, often bridging the gap between a satisfactory experience and an exceptional one.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

SEPTEMBER 11, 2024

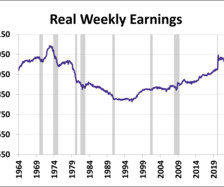

This series has been updated to include the August release of the consumer price index as the deflator and the monthly employment update. The latest hypothetical real (inflation-adjusted) annual earnings are at $51,005, down 6.7% from over 50 years ago. After adjusting for inflation, hourly earnings are below their all-time high from April 2020.

Carson Wealth

SEPTEMBER 11, 2024

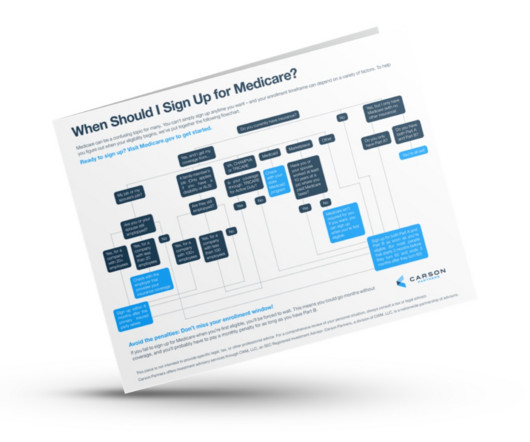

Medicare can be a confusing topic for many. You can’t simply sign up anytime you want – and your enrollment timeframe can depend on a variety of factors. To help you figure out when your eligibility begins, we have put together the following flowchart. Download the checklist today to get started. The post When Should I Sign Up for Medicare appeared first on Carson Wealth.

Advisor Perspectives

SEPTEMBER 11, 2024

Banks and shadow banks are meant to exist in separate worlds, but the financial links between them are increasingly seen as a source of potential instability. That’s a problem for banks because the business of forging those ties has lately been among the hottest activities on Wall Street.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content