Sunday links: when ideas combine

Abnormal Returns

JUNE 18, 2023

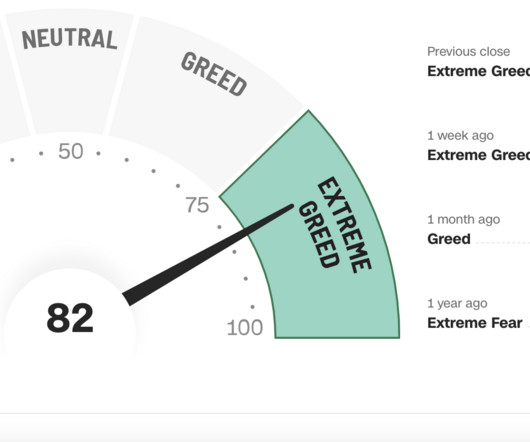

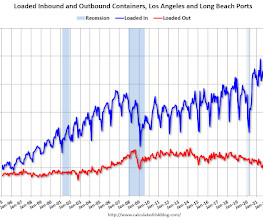

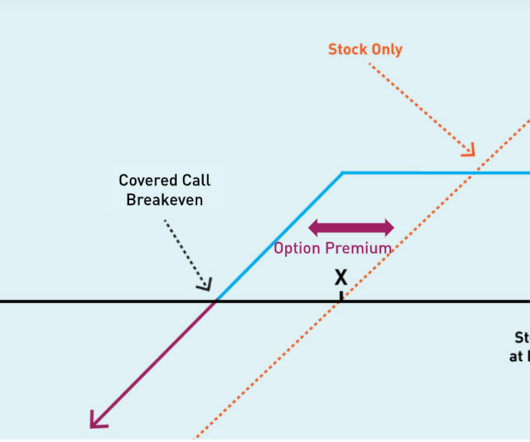

Markets Joshua Brown, "The thing that everyone’s talking about is not always the thing that ends up mattering." (thereformedbroker.com) Three reasons why the stock market is higher this year. (tker.co) Higher yields are the biggest potential headwind for stocks. (awealthofcommonsense.com) Strategy To reach the top level of a craft you have to have a passion for it.

Let's personalize your content