T3: Cybersecurity Adoption Still ‘Woefully Low’

Wealth Management

MARCH 14, 2023

However, advisory firms who did invest in cybersecurity tools reported higher levels of satisfaction with them than in any other software category.

Wealth Management

MARCH 14, 2023

However, advisory firms who did invest in cybersecurity tools reported higher levels of satisfaction with them than in any other software category.

The Big Picture

MARCH 14, 2023

My Two-for-Tuesday morning train reads: • Bank Runs, Now & Then : The Panic of 1907 would probably be more famous if it wasn’t overshadowed by the Great Depression just a couple of decades later. It lasted 15 months and saw GDP decline an estimated 30% (even more than the Great Depression). Commodity prices crashed. Bankruptcies exploded. The stock market fell 50%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 14, 2023

What is the 1/N strategy and why would you use it?

Calculated Risk

MARCH 14, 2023

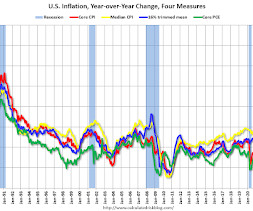

Here a few measures of inflation: The first graph is the one Fed Chair Powell has been mentioning. Click on graph for larger image. This graph shows the YoY price change for Services and Services less rent of shelter through February 2023. Services were up 7.6% YoY as of February 2023, unchanged from 7.6% YoY in January. Services less rent of shelter was up 6.9% YoY in February, down from 7.2% YoY in January.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MARCH 14, 2023

Revised Form 1040 lays the foundation for a new integrated regulatory framework around this asset class.

Calculated Risk

MARCH 14, 2023

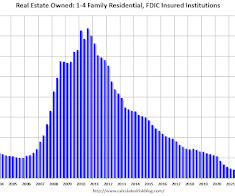

Today, in the Calculated Risk Real Estate Newsletter: Q4 Update: Delinquencies, Foreclosures and REO A brief excerpt: In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. However, this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most home

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Abnormal Returns

MARCH 14, 2023

Strategy What investing lessons can we cull from the downfall of SVB? (portfoliocharts.com) Safe assets aren't safe if there is a duration mismatch. (fortunesandfrictions.com) Even great companies will 'decline eventually.' (neckar.substack.com) Silicon Valley Bank There is plenty of blame to go around for the downfall of SVB including the pandemic.

Wealth Management

MARCH 14, 2023

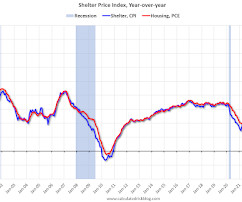

Underlying consumer-price growth accelerated in February, with Americans continuing to experience the sting of rising rents and sticky prices for services. Over the past year, a key housing category — which includes everything from actual rents to what a homeowner would charge in rent to hotel stays — climbed a record 8.2%.

Calculated Risk

MARCH 14, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 8:30 AM, Retail sales for February is scheduled to be released. The consensus is for a 0.3% decrease in retail sales. • Also at 8:30 AM, The Producer Price Index for February from the BLS.

Wealth Management

MARCH 14, 2023

The Real Deal looks at what’s happening with real estate customers of Signature Bank. A new report from CBRE indicates that a drop in commercial property values might not last long. These are among today’s must reads from around the commercial real estate industry.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

The Irrelevant Investor

MARCH 14, 2023

It has been 872 days since a bank failed in the United States. This was the longest streak on record. We’re now at day zero. Silicon Valley bank went down on Friday. Signature Bank last night. These are the second and third largest bank failures in history behind Washington Mutual during the GFC. People are scared, mad, and looking for someone to blame.

Wealth Management

MARCH 14, 2023

During a panel at the IAA Compliance Conference, one CCO worried the demand included in the SEC’s proposed cyber rule didn’t give firms enough time to determine what happened.

The Reformed Broker

MARCH 14, 2023

Final Trades: DocuSign, Citigroup, Adobe & more from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

MARCH 14, 2023

The head of Brookfield Oaktree Wealth Solutions discusses the RIA landscape and how alternatives have shifted from institutional to individual investors.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

MARCH 14, 2023

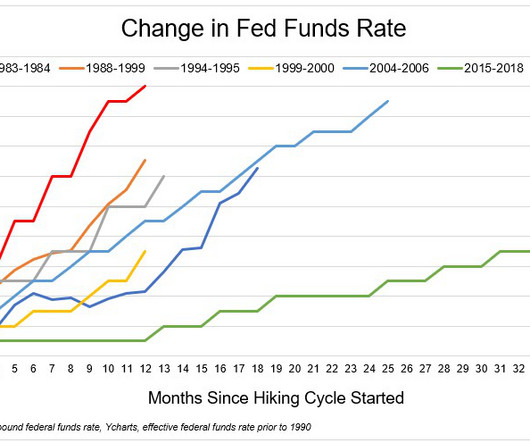

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Silicon Valley Humiliated – Sit down, be humble. Maybe less tweets. ►What Now for Banks? – “Interest rates on bank deposits have lagged the Fed” ►Orange County – Fed was finished once O.

Wealth Management

MARCH 14, 2023

Brookfield Managing Partner Zachary Vaughan spoke with WMRE about the firm’s debt investments and how its partnership with Oaktree has expanded capabilities.

Calculated Risk

MARCH 14, 2023

From the BLS : The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in February on a seasonally adjusted basis , after increasing 0.5 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.0 percent before seasonal adjustment. The index for shelter was the largest contributor to the monthly all items increase, accounting for over 70 percent of the increase, with the indexes for food, recreation, and ho

Wealth Management

MARCH 14, 2023

What clients need to know as shock waves ripple through the US financial system after the swift collapse of SVB.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

MARCH 14, 2023

The Cleveland Fed released the median CPI and the trimmed-mean CPI: According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.6% in February. The 16% trimmed-mean Consumer Price Index increased 0.5% in February. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Wealth Management

MARCH 14, 2023

The FDIC said it will fully protect depositors after Silicon Valley Bank’s implosion. But wealth advisors say clients should strategize about where they park their cash.

Calculated Risk

MARCH 14, 2023

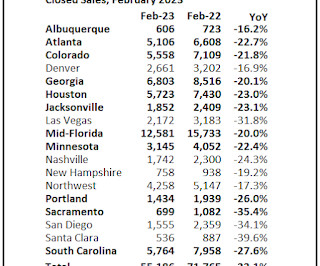

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in February A brief excerpt: This is the second look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Wealth Management

MARCH 14, 2023

The Atlas Capital Team Index, or ACT, offers a mix of short-term and inflation-protected US Treasuries, as well as gold and US real estate investment trusts.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Nerd's Eye View

MARCH 14, 2023

Welcome back to the 324th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Nancy Knous. Nancy is the CEO and Founder for Benchmark Wealth Management, an independent RIA affiliated with LPL Financial based in Memphis, Tennessee, that oversees nearly $340 million in assets under management for almost 1000 client households.

Abnormal Returns

MARCH 14, 2023

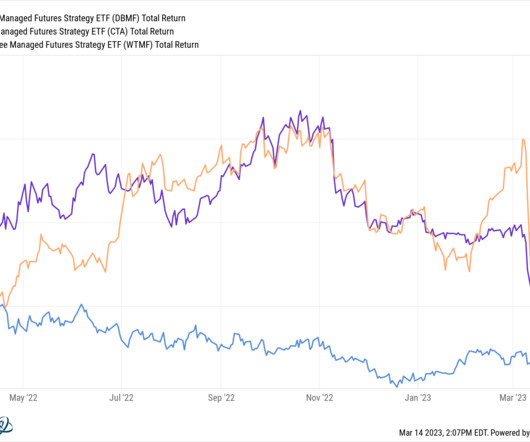

Quant stuff Ben Carlson, "The biggest problem I have with most backtests is that it’s always going to be easier to find a strategy that worked well in the past than to discover one that works well in the future." (awealthofcommonsense.com) A round-up of recent research on ETFs including 'On the Anomaly Tilts of Factor Funds.' (capitalspectator.com) On the dangers of data mining and selection bias.

Steve Sanduski

MARCH 14, 2023

Guest: Gayle Colman , Certified Financial Planner®, Master Integral Coach®, and author of the new book The Body of Money. In a Nutshell: Financial decisions are often framed as a tug of war between the head and the heart. But by paying attention to how the whole body expresses feelings around money, advisors can guide clients past their fears and towards a fulfilling sense of sufficiency and inner knowing. – Gayle Colman and I discuss: Gayle’s early history with the life planning mov

A Wealth of Common Sense

MARCH 14, 2023

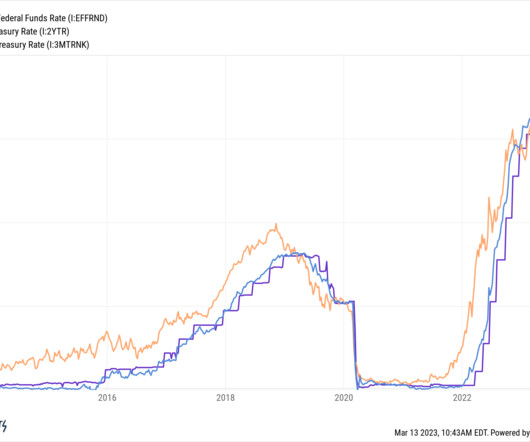

On last week’s Animal Spirits we asked why the Fed’s aggressive rate cuts had yet to break anything in the economy: Sure, the housing market is basically broken, but everything else has held up relatively well…until last week that is. We recorded our show on Tuesday. By the weekend we would see the 2nd and 3rd largest bank failures in U.S. history, including the biggest bank run we’ve ever seen.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Clever Girl Finance

MARCH 14, 2023

Do you want to start investing , but find you're a little confused about how exactly an investment like stocks or bonds makes money? If so, you’re not alone. Portfolio income is the money you make from an investment account, and there are several ways to earn it. In this article, you'll find out more about what this is and how to earn it. We’ll also go over the benefits of growing the income for your portfolio and how to deal with taxes from investments!

Norman Marks

MARCH 14, 2023

I have seen some unfortunate postings on social media and in the news. Self-appointed experts telling us what happened, why, and whose fault it was. There’s a political battle going on as well, with people blaming federal government administrations, regulators, and so on. I’m not going to get into that.

MarketWatch

MARCH 14, 2023

Moody’s Investors Service on Tuesday downgraded the U.S. banking system to negative from stable. The rating agency said the move reflects “the rapid deterioration in the operating environment” following deposit runs and failures of Silicon Valley Bank, Signature Bank and Silvergate Bank. “Although the Department of the Treasury, Federal Reserve and FDIC announced that all depositors of SVB and Signature Bank will be made whole, the rapid and substantial decline in bank depositor and investor con

Indigo Marketing Agency

MARCH 14, 2023

The collapse of a bank is a significant event—one that can cause shockwaves throughout the financial industry. In the case of the Silicon Valley Bank failure, it can be particularly alarming for those invested in the technology sector. As a financial advisor, it’s crucial to effectively communicate this event to your clients to help them understand the potential impact it may have on their investments and overall financial well-being.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content