Top clicks this week on Abnormal Returns

Abnormal Returns

NOVEMBER 19, 2023

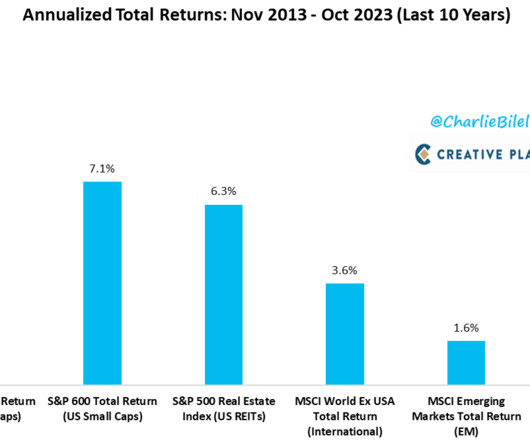

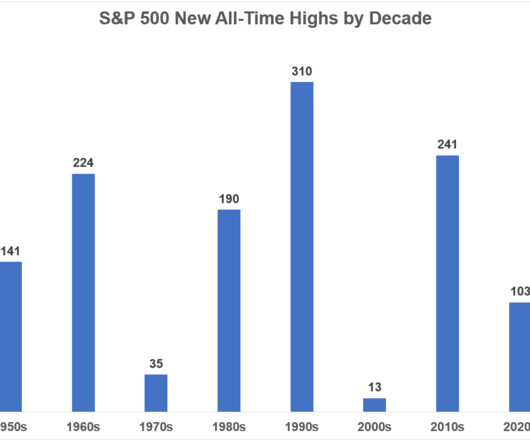

Also on the site this week Over a lifetime, you can accumulate a lot of stuff. The chances are nobody wants any of it. (abnormalreturns.com) Top clicks this week Why it's a great time to be an investor. (blog.validea.com) Some behavioral hacks to prevent you from blowing up your portfolio. (ritholtz.com) What it going to happen to all those assets in money market fund when yields eventually fall?

Let's personalize your content