The 2024 Green Book Limits Use of Defined Value Clauses

Wealth Management

MARCH 17, 2023

It also provides for increased reporting about trusts.

Wealth Management

MARCH 17, 2023

It also provides for increased reporting about trusts.

Calculated Risk

MARCH 17, 2023

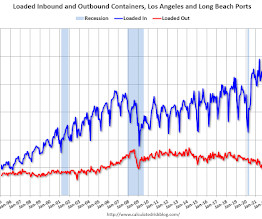

Notes: The expansion to the Panama Canal was completed in 2016 (As I noted several years ago ), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast. Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 17, 2023

It could be the difference between building a resilient practice and one that crumbles as soon as you step down.

Abnormal Returns

MARCH 17, 2023

Finance Why First Republic Bank ($FRC) isn't bouncing. (thebasispoint.com) WeWork ($WE) has reached a deal with Softbank to restructure its debt. (nytimes.com) Fidelity Crypto is now live. (theblock.co) SVB SVB didn't go bust because it was woke. (theverge.com) But poorly managed remote work maybe did. (axios.com) How the downfall of SVB could affect climate and biotech startups.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MARCH 17, 2023

Amid the immediate uncertainty around the Fed’s efforts to restore confidence, the battle against inflation suddenly looks easier.

Calculated Risk

MARCH 17, 2023

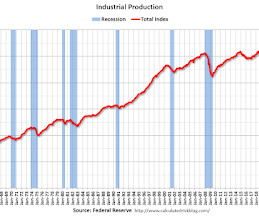

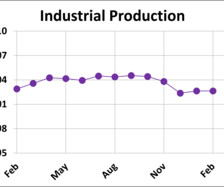

From the Fed: Industrial Production and Capacity Utilization Industrial production was unchanged in February , and manufacturing output edged up 0.1 percent. The index for mining fell 0.6 percent, while the index for utilities rose 0.5 percent. At 102.6 percent of its 2017 average, total industrial production in February was 0.2 percent below its year-earlier level.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Calculated Risk

MARCH 17, 2023

From BofA: On net, since the last weekly publication, this pushed up our 1Q US GDP tracking estimate from 0.7% q/q saar to 0.9% q/q saar and left 4Q unchanged at 2.9% q/q saar. [Mar 17th estimate] emphasis added From Goldman: We left our Q1 GDP tracking estimate unchanged at 2.6% (qoq ar). [Mar 16th estimate] And from the Altanta Fed: GDPNow The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 3.2 percent on March 16 , unchanged from Mar

Wealth Management

MARCH 17, 2023

Shares of First Republic have plummeted 81% this year.

Calculated Risk

MARCH 17, 2023

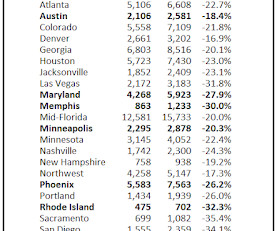

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in February 3rd Look at Local Housing Markets in February A brief excerpt: This is the third look at local markets in February. I’m tracking about 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Wealth Management

MARCH 17, 2023

It was a slower week for dealmaking in the RIA space, but Carson made its first full acquisition of the year and Buckingham Strategic Wealth announced its third.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

A Wealth of Common Sense

MARCH 17, 2023

There were a lot of surprising details that came to light from the Silicon Valley Bank fiasco. It was surprising how quickly a bank run took hold for such a large institution. It was surprising how quickly the bank’s customers fled one of their most trusted partners. It was surprising how seemingly little oversight this now systemically important bank had.

Wealth Management

MARCH 17, 2023

Pontera CMO Nicole Zheng how advisors should approach the concept of holistic advice with clients, especially surrounding retirement planning.

Abnormal Returns

MARCH 17, 2023

The biz Are podcasts thriving because of the decline of third places? (fastcompany.com) What podcasters think about different podcast publishers. (podnews.net) Companies Aimee Keene talks with Neeraj Arora about how the Facebook deal for WhatsApp came together. (shows.acast.com) Matt Reustle and Dom Cooke talk with Simon Owens about building a modern media business.

Wealth Management

MARCH 17, 2023

Clients moved money from two Schwab Value Advantage Money funds, which had a combined $195 billion of assets as of March 15, representing the largest redemptions in at least six months.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

MARCH 17, 2023

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Dan McMurtrie, and Downtown Josh Brown discuss Credit Suisse, treasury yields, short sellers, credit default swaps, the real reason Signature Bank got taken out, and much more! You can listen to the whole thing below, or find it wherever you like to listen to your favorite pods!

Advisor Perspectives

MARCH 17, 2023

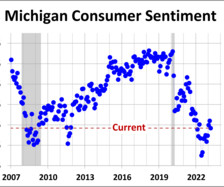

The March preliminary report for the Michigan Consumer Sentiment Index came in at 63.4, down 3.6 (-5.4%) from the February final. This morning's reading was the first monthly decline in the last four months and came in below the Investing.com forecast of 66.9. Since its beginning in 1978, consumer sentiment is 25.7% below its average reading (arithmetic mean) and 24.7% below its geometric mean.

Alpha Architect

MARCH 17, 2023

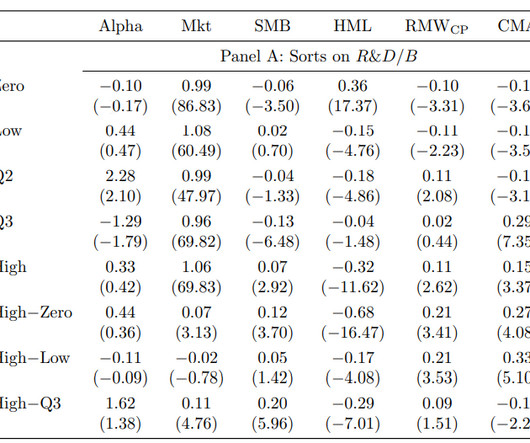

Regardless of the model used, an anomaly for all models is that the empirical evidence demonstrates that stocks with high research and development (R&D) expenses have delivered a premium. <strong>Research and Development, Expected Profitability, and Expected Returns</strong> was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Good Financial Cents

MARCH 17, 2023

Have you ever wondered how much your annual salary would be if you earned 25 dollars an hour? The fact is, too many people who earn an hourly wage don’t know how much they make in a year. This information is critical if you want to create a budget and manage your money correctly. In this article, I’ll show you how to calculate your annual income by converting a $ 25-an-hour wage to a yearly salary.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

MARCH 17, 2023

I've updated this series to include the February release of the consumer price index as the deflator and the monthly employment update. The latest hypothetical real (inflation-adjusted) annual earnings are at $48,172, down 8.2% from 50 years ago. Hourly earnings are below their all-time high after adjusting for inflation.

MarketWatch

MARCH 17, 2023

A group of 20 California House Democrats, including Rep. Adam Schiff, called on federal law enforcement Friday to investigate the relationship between Goldman Sachs and Silicon Valley Bank. In a letter sent to the heads of the Justice Department, Securities and Exchange Commission and Federal Deposit Insurance Corporation, the lawmakers raised “concerns over the role of Goldman Sachs Group in advising SVB and the purchase of its bond portfolio.

Advisor Perspectives

MARCH 17, 2023

Merely advertising your presence in the marketplace is too vague and unspecific. It fails to project authority and generate trust.

MarketWatch

MARCH 17, 2023

A group of 20 House Democrats from California, including Rep. Adam Schiff, called on federal law enforcement Friday to investigate the relationship between Goldman Sachs and Silicon Valley Bank. In a letter sent to the heads of the Justice Department, Securities and Exchange Commission and Federal Deposit Insurance Corporation, the lawmakers raised “concerns over the role of Goldman Sachs Group in advising SVB and the purchase of its bond portfolio.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

MARCH 17, 2023

The latest Conference Board Leading Economic Index (LEI) for February was down 0.3% to 110.0 from January's final figure of 110.3, marking the 11th consecutive MoM decline. Today's reading was consistent with the Investing.com forecast.

MarketWatch

MARCH 17, 2023

Struggling home-goods retailer Bed Bath & Beyond Inc. BBBY on Friday said it planned to hold a special meeting in which shareholders would vote on whether to allow the company to carry out a reverse stock split, should its board decide to do so. Shares tumbled 19% after hours. Shareholder approval would amend Bed Bath & Beyond’s certificate of incorporation to carry out “a reverse stock split of the Company’s common stock, par value $0.01 per share, at a ratio in the range of 1-for-5 to 1-for-10

Dear Mr. Market

MARCH 17, 2023

Dear Mr. Market: SVB (Silicon Valley Bank) logo is seen through broken glass in this illustration taken March 10, 2023. REUTERS/Dado Ruvic/Illustration A part of us cringes as we succumb to the pressure of having to write about the most recent worrisome headline. Why? It’s sort of like the Kardashians or trashy television personalities in general; the more you talk about it the more it gives some the perception that it’s worth talking about.

MarketWatch

MARCH 17, 2023

Could Alphabet Inc.’s foray into artificial intelligence, Bard, “blow a hole” in its margins? It’s a question posed by UBS analyst Lloyd Walmsley posed in a note Thursday. After careful consideration, he expects costs to come subside quickly. “We see cost risk around the integration of generative AI into Google search results as manageable,” Walmsley wrote, in reiterating a buy rating on Google shares.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Advisor Perspectives

MARCH 17, 2023

This morning's report revealed industrial production numbers were unchanged in February despite expectations that industrial production would inch up 0.2%. The annual change dropped below zero for the first time in two years to -0.25%, down from last month's year-over-year increase of 0.49%. The annual change was well below the forecast of 3.0%.

MarketWatch

MARCH 17, 2023

SVB Financial Group SIVB said Friday it has filed for Chapter 11 bankruptcy in New York and will seek a court-supervised reorganization. The company said the filing does not include SVB Capital or SVB Securities funds and general partner entities, which are continuing to operate as SVB Financial explores its strategic options. SVB Financial is no longer affiliated with Silicon Valley Bank, which was placed in receivership last week after a run on its deposits.

Harness Wealth

MARCH 17, 2023

An Introduction to DeFi Decentralized Finance (DeFi) is a rapidly evolving space, offering blockchain-based financial applications that enable individuals and businesses to access various financial services, including lending, borrowing, trading, and earning interest without traditional financial institutions as intermediaries. By leveraging smart contracts and decentralized networks, DeFi aims to create an open, transparent, and accessible financial system.

MarketWatch

MARCH 17, 2023

Wedbush on Friday downgraded First Republic Bank stock FRC to neutral from outperform and slashed its price target on the stock to $5 a share, a fraction of its current level of around $29 a share in premarket trades. While the $30 billion deposit infusion by 11 banks is a plus, the bank has also grown liabilities to shore up its liquidity, analysts said.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content