10 Weekend Reads

The Big Picture

MARCH 23, 2024

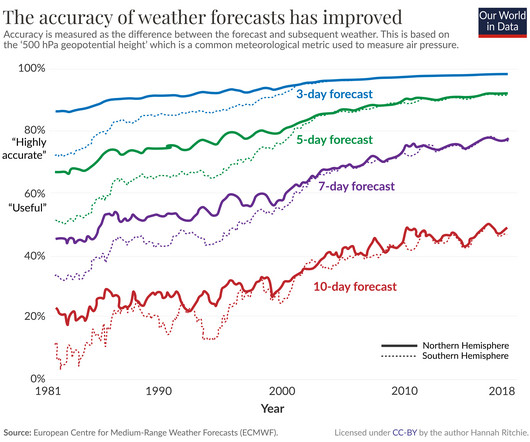

Billionaires know they are. Low-wage workers are very well aware that they aren’t. But vast swaths of America’s “regular rich” don’t feel that way, and it’s keeping everybody down. [link] via Bloomberg. Electric Boogie Woogie Wagon [link] 17 astounding scientific mysteries that researchers can’t yet solve What is the universe made out of?

Let's personalize your content