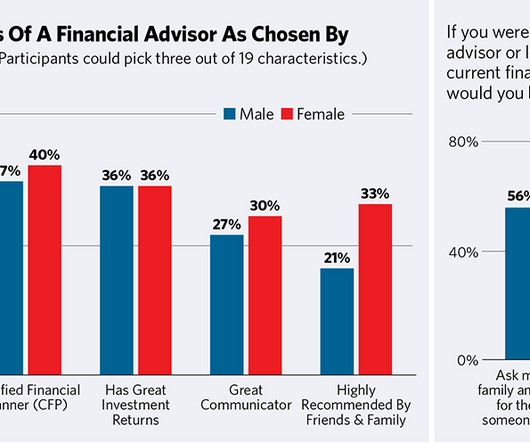

Adviser links: personability and empathy

Abnormal Returns

JANUARY 1, 2024

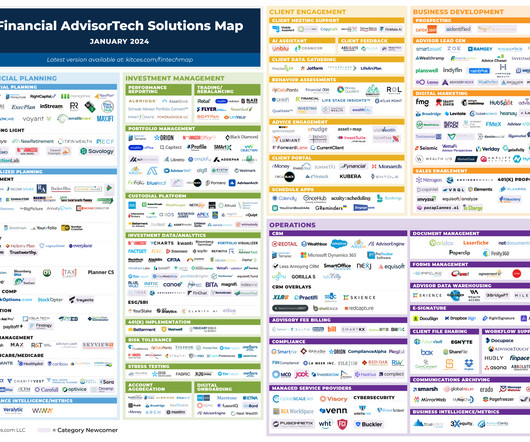

Podcasts Michael Kitces talks with Rob Nelson who is the CEO and Founder of NorthRock Partners about offering clients a wider set of services. (kitces.com) Thomas Kopelman on the power of backdoor Roth IRA conversions. (podcasts.apple.com) Advisers The RIA keeps taking market (and mind) share. (thinkadvisor.com) A review of the RIA world in 2023. (riabiz.com) Can a fiduciary adviser safely use AI-generated advice?

Let's personalize your content