Q&A: What Makes SUBSCRIBE Tick

Wealth Management

OCTOBER 23, 2024

The tech firm has quietly become a key cog in the alternative investment ecosystem.

Wealth Management

OCTOBER 23, 2024

The tech firm has quietly become a key cog in the alternative investment ecosystem.

Calculated Risk

OCTOBER 23, 2024

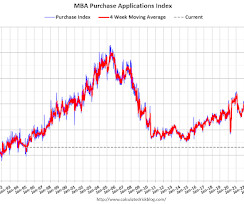

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 6.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending October 18, 2024. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.7 percent on a seasonally adjusted basis from one week earlier.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 23, 2024

How a versatile planning tool can benefit clients and advisors alike.

Abnormal Returns

OCTOBER 23, 2024

Companies Google's ($GOOGL) big businesses are in a slow, decline. (wheresyoured.at) Starbucks' ($SBUX) new CEO is clearing the decks. (bloomberg.com) Walmart ($WMT) is expanding home delivery of pharmaceuticals. (fastcompany.com) Finance Howard Marks thinks nearly every investor should look at private debt. (on.ft.com) Banks are increasingly backing capital call loans.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Calculated Risk

OCTOBER 23, 2024

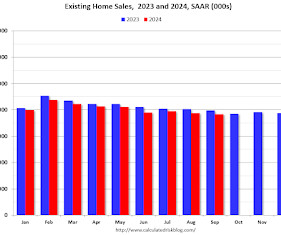

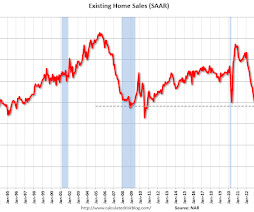

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.84 million SAAR in September, New Cycle Low Excerpt: Sales Year-over-Year and Not Seasonally Adjusted (NSA) The fourth graph shows existing home sales by month for 2023 and 2024. Sales declined 3.5% year-over-year compared to September 2023. This was the thirty-seventh consecutive month with sales down year-over-year.

Wealth Management

OCTOBER 23, 2024

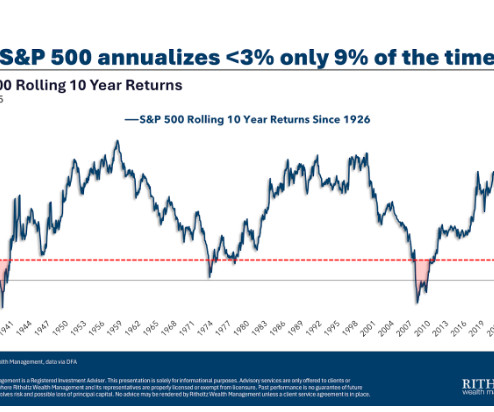

Equities, in particular, have historically shown robust performance during these intervals of stable inflation.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

Wealth Management

OCTOBER 23, 2024

The founding members include Mariner Wealth Advisors, Halbert Hargrove and Modera Wealth Management. Co-Chairs Gerry Goldberg and Grant Rawdin hope the initiative will help firms adopt best practices for servicing communities.

Calculated Risk

OCTOBER 23, 2024

From the NAR: Existing-Home Sales Slid 1.0% in September Existing-home sales drew back in September, according to the National Association of REALTORS®. Three out of four major U.S. regions registered sales declines while the West experienced a sales bounce. Year-over-year, sales fell in three regions but grew in the West. Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – receded 1.0% from August to a seasonally adjusted ann

Wealth Management

OCTOBER 23, 2024

Digital assets and social media fraud were frequently cited in the states’ investigations and enforcement actions in 2023, according to a new NASAA report.

Calculated Risk

OCTOBER 23, 2024

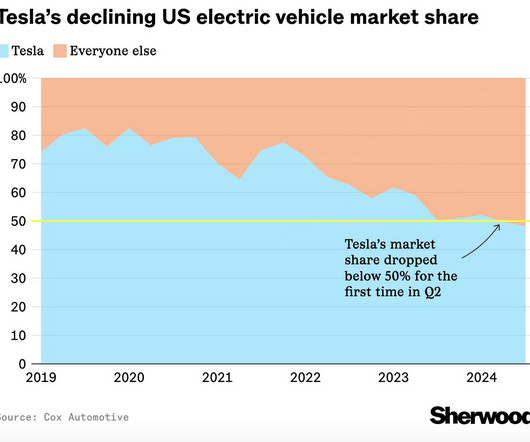

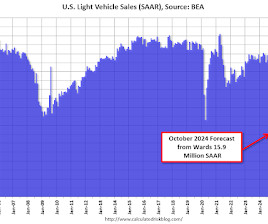

From WardsAuto: October U.S. Light-Vehicle Sales Forecast to Start Q4 with Small Gain (pay content). Brief excerpt: The fourth quarter is forecast to total 4.13 million units, 6.0% above year-ago’s 3.89 million, which was tamped down because of labor-related strikes at three automakers that pared inventory emphasis added Click on graph for larger image.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

OCTOBER 23, 2024

A recent study identifies gender and age as significant influencers in philanthropy.

Calculated Risk

OCTOBER 23, 2024

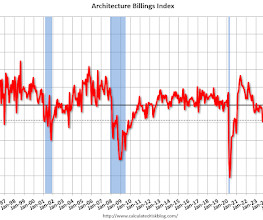

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: Architecture firm billings worsened in September The AIA/Deltek Architecture Billings Index (ABI) score was 45.7 for the month , as the majority of firms continued to report declining billings. Despite recently announced rate cuts by the Federal Reserve, clients are still cautious about future projects.

Wealth Management

OCTOBER 23, 2024

Wednesday, November 20, 2024 | 1:00 PM Eastern Standard Time

The Big Picture

OCTOBER 23, 2024

At The Money: BlackRock on Building a Bond Ladder (October 23, 2024) Full transcript below. ~~~ About this week’s guest: Karen Veraa is a Fixed Income Product Strategist within BlackRock’s Global Fixed Income Group focusing on iShares fixed-income ETFs. She supports iShares clients, generates content on fixed-income markets and ETFs, develops new fixed-income iShares ETF strategies, and partners with the iShares team on product delivery.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Wealth Management

OCTOBER 23, 2024

Open, honest and candid discussion about using data to cross sell, whether the DC system can handle a mobile workforce, a sea change happening now and more.

Calculated Risk

OCTOBER 23, 2024

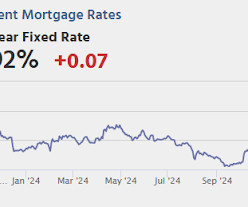

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 247 thousand initial claims, up from 241 thousand last week. • Also at 8:30 AM, Chicago Fed National Activity Index for September. This is a composite index of other data. • At 10:00 AM, New Home Sales for September from the Census Bureau.

Trade Brains

OCTOBER 23, 2024

Deloitte has released a promising forecast for India’s economic growth. The report predicts GDP growth between 7 and 7.2 percent for FY 2024-2025. Moreover, this matches the RBI’s own growth projection of 7.2 percent. Dr. Rumki Majumdar sees India’s economy showing strong resilience after the election period. The country maintains its position among the world’s fastest-growing large economies.

Calculated Risk

OCTOBER 23, 2024

Fed's Beige Book On balance, economic activity was little changed in nearly all Districts since early September , though two Districts reported modest growth. Most Districts reported declining manufacturing activity. Activity in the banking sector was generally steady to up slightly, and loan demand was mixed, with some Districts noting an improvement in the outlook due to the decline in interest rates.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Trade Brains

OCTOBER 23, 2024

Benchmark indices fell in early trade amid selling pressure on Monday. The BSE Sensex index lost 299 points to open at 79,921.13, down by 0.37 percent, in early trade. On the other hand, the Nifty 50 index opened at 24,378.15, down by 93.95 points or 0.38 percent. However, investment and brokerage firm Prabhudas Lilladher has advised buying a few PSU stocks for 1 year.

Diamond Consultants

OCTOBER 23, 2024

Competition and an expanded landscape of options have resulted in additional deal structures for transitioning advisors. Advisors are a lucky lot: They have many ways to monetize their life’s work and take advantage of new opportunities for growth, both in the short and long term. The transition deal is one way that advisors can financially de-risk a move through what is traditionally known as a forgivable loan—a note that typically binds the advisor to the firm for a given length of time.

Trade Brains

OCTOBER 23, 2024

The zinc market has witnessed a remarkable upturn, with prices climbing steadily to Rs 289.6 per kilogram. Moreover, this surge stems from China’s economic stimulus measures and growing supply concerns in global markets. Consequently, the International Lead and Zinc Study Group now predicts a substantial deficit of 164,000 tonnes in 2024. Furthermore, this dramatic shift from an expected surplus has intensified market pressure.

A Wealth of Common Sense

OCTOBER 23, 2024

Today’s Animal Spirits is brought to you by YCharts and CME Group: See here for 20% off your initial YCharts professional subscription See here for more information on adding futures to your portfolio with CME Group See here to subscribe to our new show, The Unlock! On today’s show, we discuss: Come work with us at the Philly office! The American economy has left other rich countries in the dust WhatR.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

SEI

OCTOBER 23, 2024

Net Sales Events, AUM, and AUA Drive Record Quarter

Steve Sanduski

OCTOBER 23, 2024

Guest: Eric Brotman , CFP®, AEP®, CPWA®, is a Principal and the Chief Executive Officer of BFG Financial Advisors. Eric began his financial planning practice in Baltimore in 1994, and founded Brotman Financial Group in 2003, which later became BFG Financial Advisors. He and his team focus on supporting families and individuals by providing comprehensive financial planning and wealth management services.

Advisor Perspectives

OCTOBER 23, 2024

Determining your client’s risk tolerance is a critical first step in constructing a tailored investment portfolio.

Trade Brains

OCTOBER 23, 2024

These two micro-cap companies surged after announcing bonus share issuance alongside strong financial performance and strategic initiatives. Stock Movement of both companies Linc Limited and Sky Gold Limited demonstrated positive momentum. Linc opened at ₹671 and is currently trading at ₹665.50, after touching a high of ₹697.40, marking an 8% surge.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Financial Symmetry

OCTOBER 23, 2024

So far, the 2024 election has provided the suspense and drama we have come to expect in presidential election years. For investors, the same questions continue to plague us as we await the winner in November. Are there signals in … Continued The post Investing Through the 2024 Election appeared first on Financial Symmetry, Inc.

Trade Brains

OCTOBER 23, 2024

Investing in stocks with high dividend yields can be an attractive strategy for income-seeking investors. Recently, a stock yielding an astonishing 480% has caught the attention of market watchers. Price Movement With a market capitalization of Rs. 12.7 crores, Taparia Tools Limited’s share price recently traded at Rs. 8.35 per share. Over the last six months, the company has given a return of 115.21 percent.

Advisor Perspectives

OCTOBER 23, 2024

Vanguard Group Inc. sees more opportunities in the lowest rung of investment-grade bonds, even as spreads for triple-B notes reached their tightest since 1998 last week.

Trade Brains

OCTOBER 23, 2024

One of the micro-cap stocks engaged in manufacturing pharmaceutical ingredients and antacid molecules. The stock has skyrocket by 12.63 percent after reporting a revenue increase of 53.31% QOQ and 33.88% YOY, and net profit increased by 239.34% QOQ and 75.72% YOY. Share Price Movement After announcing its quarterly results, Par Drugs and Chemicals Limited’s share has skyrocket by 12.63 percent from the previous close of Rs. 266.56.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content